How to Locate the Sites of Industrial Park Projects

The site selection of industrial park projects needs to be considered from multiple perspectives and multiple dimensions. It not only involves the requirements on the economic strength of industrial park investors, the professional and technical background of operation team, project financing means and ability, but also involves the influence of many external factors such as the underlying logic of the industry, social environment, natural conditions, government support and market supply.

At the same time, it must be clearly recognized that the site selection of industrial park project is the first key decision for the success of the park, and whether the site selection is successful determines the future development potential of the project and even the life and death of the project. The operator of Gewu Evolution industry believes that the site selection and positioning of industrial park projects can be divided into three steps: the first step is to select urban agglomeration according to the economic strength of the city; The second step, according to the regional characteristics to establish the project site selection evaluation model; The third step, precise industrial positioning, a blueprint to the end.

The first step is to classify cities according to their economic strength and make pre-selection of urban agglomeration

1. First-tier cities in the mature stage, typical representative cities such as Beijing, Shanghai, Guangzhou and Shenzhen, have a GDP of more than 2 trillion yuan, with tertiary industries accounting for more than 60% of the total. This kind of city has developed into a large scale and strong economic strength, and the four places in Beijing, Shanghai, Guangzhou and Shenzhen have become the advantageous areas for industrial park site selection. However, at the same time, the supply of urban land is constantly shrinking, land has become a scarce resource, and the acquisition of project land is extremely difficult, and it is easy not to enter the city without sufficient grasp.

2. Fast growing new first-tier cities, typical representative cities: Chengdu, Hangzhou, Chongqing, Wuhan, Suzhou, Nanjing, Zhengzhou, Changsha, Qingdao, Ningbo, Dongguan, Wuxi, Xi 'an, etc., with a GDP scale of 1-2 trillion yuan, and the proportion of the three industries is 40%-60%. With the rapid economic development momentum of new first-tier cities and the new direction of national strategic development, these regions have become the first choice to undertake the industrial transfer of Beijing, Shanghai, Guangzhou and Shenzhen. In addition, due to the increasingly fierce recruitment war in the new first-tier cities, these cities have become potential cities for talent gathering in the future. If there is an opportunity, we must not miss it, even if the cost is a little higher.

3. Second-tier cities in the early stage of development, typical representative cities: Kunming, Dalian, Xiamen, Hefei, Foshan, Fuzhou, Wenzhou, Nanchang, Jinan, Shenyang and about 30 other cities, the GDP scale of 500 to 1 trillion yuan, the proportion of the three industries is less than 40%. The development of second-tier cities is relatively stable, so whether there are major national strategic opportunities, favorable preferential policies, and obvious regional advantages should be considered comprehensively when the city is judged.

4. Third, fourth and fifth tier cities in the embryonic stage, typical representative cities: Zhuhai, Zhenjiang, Haikou, Yangzhou, Linyi, Luoyang, Tangshan, Shantou, Langfang, Taizhou, Huzhou and other cities, the GDP scale is less than 500 billion, and the proportion of three industries is less than 40%. Due to restrictions on location, policies and other factors, the economic development of these areas is relatively slow. Therefore, it is necessary to be cautious when deciding whether to enter a city, and do not seek temporary cheap prices. The unique resource endowment when entering this kind of city is the key to the site selection of industrial park projects.

The second step is to establish a 3-12plus evaluation model for project site selection according to regional characteristics

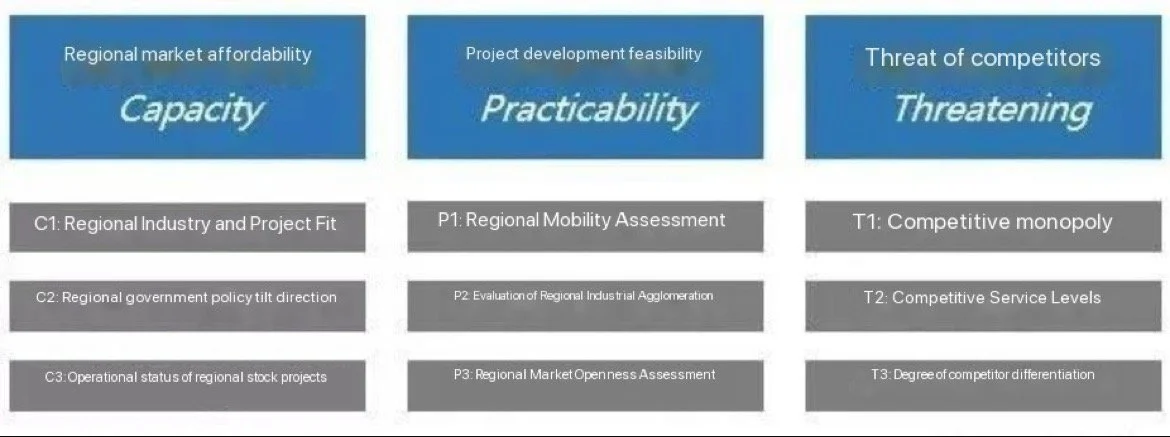

Using the 3-12Plus pre-selected city evaluation model of Gewu Evolution Industry operating organization, the target city is screened and evaluated in the next step. The next step can be made to judge the target city from three big dimensions, which are: regional market accessibility, regional acceptability analysis of industrial park; Customer development feasibility, regional park development feasibility analysis; The threat of competitors and the challenges to new entrants in the regional parks. Each evaluation dimension can be evaluated from four small indicators. The weighted weight is not considered for the time being, and only the indicators are quantified for the reference of the final decision. See the table below:

The above only represent part of the views of the operating institutions of the evolution industry.

The third step is precise positioning of the industry, a blueprint to the end

Due to the lack of unified scientific planning and accurate positioning at the beginning of the development of most industrial parks, the phenomenon of headache and pain appeared in the process of the development of the park. The usual problems include: excessive industry types and disorderly layout in the industrial park; Industrial correlation degree is small, set but not gather; Serious homogeneity, excessive competition; One-sided pursuit of high-tech industries.

The precise positioning of the industry is an important foundation for the park to attract investment in the early stage, which is conducive to helping the industrial park get rid of the traditional extensive development mode. The understanding of industrial selection and the location of the park is the premise of positioning, and the sorting of the industrial chain and the trend research are the key to positioning. Therefore, industrial positioning can be fully considered and measured from three aspects, which are the situation of target city, industrial development status and industrial development trend.

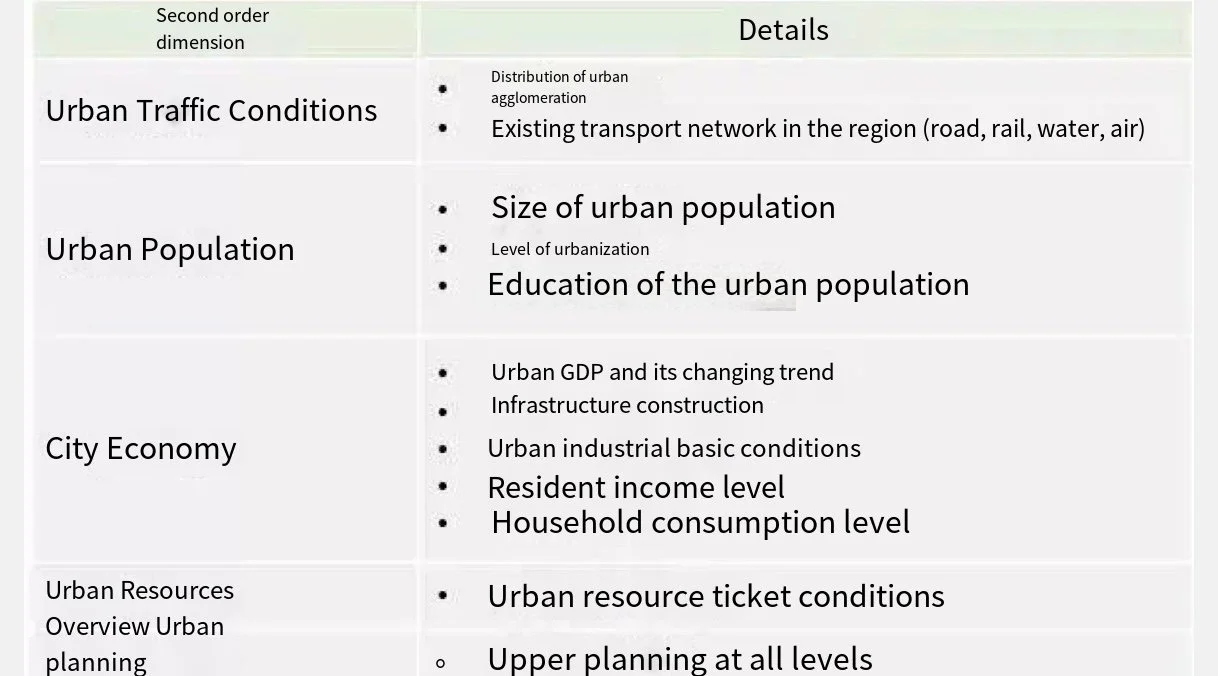

1. See the table below for details of target cities

2. Industrial development status of target cities

Take integrated circuit as an example to understand the distribution of each link of the industrial chain, and determine the feasibility analysis of industrial positioning of industrial parks according to the regional industrial distribution.

3. Industrial development trends of target cities are shown in the table below

On this basis, we should follow seven principles in the actual site selection operation: strategy-oriented principle, planning-oriented principle, land saving principle, convenient transportation principle, relying on existing infrastructure principle, green ecological principle and talent gathering principle. The following factors should be taken into consideration when evaluating the specific entry of industrial park projects: Does the positioning of the project conform to the development vision of the local government? Is there local land available for development? Is there local pressure for tax increases? How urgent is the local industry upgrading and adjusting? Is there a desire to improve the city's image? Can the revenue of the local government support the development plan?

In summary, the site selection and industrial positioning of industrial park projects have a set of systematic methodology and tools. A good site selection strategy and accurate industrial positioning will lay a good foundation for the development of industrial park, and also the beginning of success.