The Impact of a Declining Chinese Economy on Its Industrial Real Estate Sector

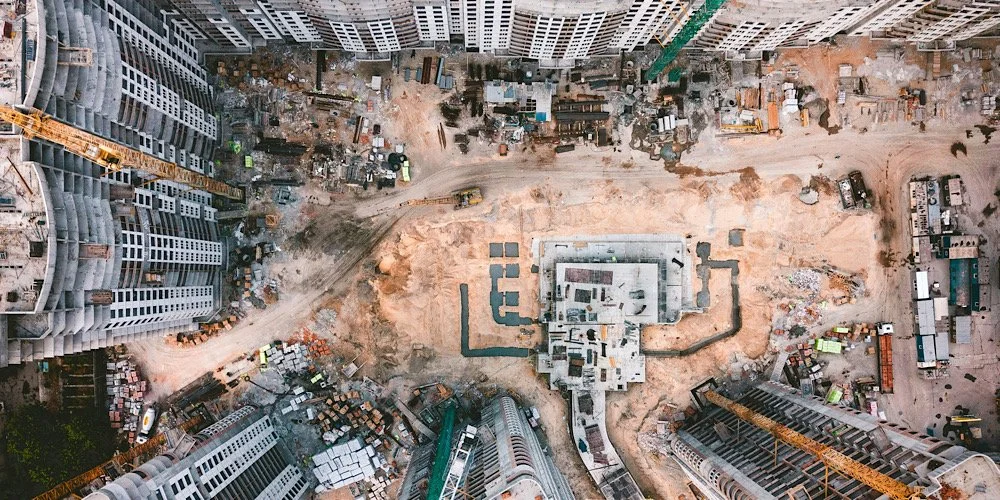

In recent years, China emerged as the world's fastest-growing major economy. However, in 2024, its economy has significantly slowed, presenting major challenges across various sectors. This downturn is attributed to factors like decreasing global growth, trade protectionism, and geopolitical tensions, alongside a persistent decline in domestic real estate, slowed investment growth, demand fluctuations, trade conflicts, and an aging population. These issues have led to a critical examination of their effects, particularly on the industrial real estate sector. Given that industrial real estate encompasses warehouses, manufacturing plants, and logistics facilities, its performance serves as a key indicator of economic health. As China navigates these economic challenges, it is essential for stakeholders to understand the implications for this vital area.

As a global manufacturing powerhouse, China boasts a vast industrial real estate market, primarily fueled by its robust supply chain and export activities. However, the ongoing economic downturn poses significant challenges for the industrial real estate sector. It's essential for investors, businesses, and policymakers to grasp these changes to effectively navigate the upcoming obstacles. The decline in exports and domestic consumption has resulted in reduced demand for manufacturing space, prompting many industrial real estate developers to reassess their strategies. Additionally, as companies seek cost-efficiency, advancements in automation and smart technology have rendered some traditional industrial spaces obsolete, leading to higher vacancy rates.

Given these challenges, one might question if there's still potential for growth in the industrial real estate sector. While immediate optimism may be uncertain, the overall trend suggests a positive outlook. Firstly, the government's initiatives to promote economic rebalancing are underway, potentially creating new opportunities. China is gradually transitioning from an investment-driven growth model to a more balanced approach that emphasizes harnessing consumer potential—as highlighted by recent policies aimed at addressing the needs of an aging society—and the flourishing service industry.

In this context, industrial real estate is poised for a transformative opportunity. Companies must adapt to evolving consumer preferences by optimizing logistics chains and distribution networks. The rapid growth of e-commerce, for instance, has significantly increased demand for logistics infrastructure, offering numerous opportunities for industrial real estate stakeholders. To thrive in this shifting landscape, relevant parties should proactively adjust their strategies, seize these opportunities, and realign their business focus to meet the new logistics demands driven by e-commerce, enabling their own transformation and advancement.

Through these adaptive measures, the industrial real estate sector can align with new economic development trends while securing a competitive edge in a challenging market. Additionally, there are indications that China is strongly promoting and investing in green technology and sustainable practices across industries, including real estate. Developers are beginning to incorporate environmental protection initiatives into their projects, ensuring that this transformation aligns with broader sustainability requirements.

For stakeholders in the industrial real estate sector—including developers, investors, and tenants—it's essential to adjust strategies to keep pace with the evolving landscape. To mitigate current risks, developers must leverage innovative technologies to enhance operational efficiency and cut costs. This could involve reconfiguring existing spaces to accommodate new demands sparked by the e-commerce surge or investing in smart technologies that lower energy expenses and streamline logistics.

Investors should adopt a cautious yet optimistic approach, focusing on non-performing assets in emerging areas that still hold promise for long-term growth. Forming partnerships with local governments can facilitate knowledge sharing and improve access to resources, enabling investors to navigate current challenges while capitalizing on future opportunities.

In summary, while the ongoing decline of China's economy poses significant challenges to the industrial real estate sector, it also creates a foundation for transformation and innovation. By recognizing shifts in demand, embracing sustainable development, and implementing proactive strategies, stakeholders can weather economic fluctuations and seize new opportunities that arise as the market evolves. Thus, the industrial real estate industry finds itself at a crossroads, requiring continued attention and active preparation for the challenges ahead.