How does the US government support technological innovation?

Strategic Frontier Technology

Technological innovation is a systematic project. Good industrial policies, accumulation of basic research, close cooperation between industry, university and research are indispensable.

Ford Professor of Economics at MIT, Jonathan Gruber, Director of the Health Care Program of the National Bureau of Economic Research, and his partner Simon Johnson in the book "A Brief History of American Innovation", Industrial Policy on American Technological Innovation The changes have been interpreted, from which we can also see the course of the development of scientific and technological innovation in the United States.

To a certain extent, the "A Brief History of American Innovation" co-authored by MIT professors Jonathan Gruber and Simon Johnson is a prosperous alarm in times of peace.

The United States' technological innovation capability, technological strength, and educational strength have been leading the world for many years. In many fields of science and technology, such advantages have also become the killer of the United States in sanctions or restraining some companies in other countries. For the Chinese, the most memorable example is that the US government banned the sale of chips to Huawei. Huawei was hit hard as a result.

Even under such circumstances, "A Brief History of American Innovation" still sounded the alarm about the lack of funding for scientific innovation by the US government. Through this book, we can not only understand classic cases in the history of American innovation, but also learn more about the current problems of American innovation.

A brief history of American innovation

In this book, Jonathan Gruber, a Ford Professor of Economics at the Massachusetts Institute of Technology and Director of the Health Care Program at the National Bureau of Economic Research, combed through the important history of American innovation, expressed concern about the current situation, and raised concerns about the future. Provide concrete and feasible strategic support.

1. The government supports technological innovation, with pearls and jade first

From the perspective of R&D investment, the United States ranks first in the world. The comparative dimension of "A Brief History of American Innovation" is not to compare the United States with other countries in terms of the amount of investment, but to compare the amount of government funding for scientific innovation in the history of the United States and the proportion of GDP.

The Chinese have a familiar saying that science and technology are the primary productive forces, but many people may not really understand the path that science and technology promote economic development and improve national competitiveness. In this regard, this book starts from actual cases in the United States and makes a convincing explanation-in terms of factors that promote economic development, scientific innovation has a spillover effect, promotes further innovation, and creates numerous job opportunities. When a country takes the lead in the most critical industry, it can take the lead in the competition between countries.

In the view of Jonathan Gruber and Simon Johnson, the successful case of the U.S. government funding for scientific innovation is the funding of scientific innovation by the National Defense Research Council led by Vannevar Bush, the former vice president and head of the engineering department of the Massachusetts Institute of Technology. He made outstanding contributions to the victory of World War II and laid the foundation for the economic growth of the United States after World War II.

On June 12, 1940, Vannevar Bush visited the White House. He suggested to President Roosevelt the establishment of a National Defense Research Committee led by scientists and engineers to control the leadership and funding of new weapons research and development. Some industrial companies don't want private top research laboratories. Roosevelt approved this request.

The founding members of Bush’s Defense Research Council included Karl Compton, then Dean of the Massachusetts Institute of Technology, Harvard University President James Conant, and President of the National Academy of Sciences and Director of Bell Labs Frank B. Juvet, California Institute of Technology Richard C. Toroman, Dean of the Graduate School. The research fields of these scientific and technological elites involve atomic theory and some emerging concepts.

At its peak, Bush led 30,000 people, including 6,000 scientists, including about two-thirds of physicists in the United States. What followed was a sharp increase in scientific research funding. In 1938, the US federal government and state governments invested 0.076% of US national income in research funding; by 1944, this figure had risen to 0.5%. Most are spent from the National Defense Research Council.

In 1945, Bush prepared a report "Science: Endless Frontiers" for President Roosevelt. He pointed out that inventions and creations can save lives, improve the quality of life and create jobs; the government should not directly engage in scientific research, and the military's scientific bureaucratic command hinders science. Explore; companies, wealthy individuals, and first-class universities cannot solely undertake and carry out the scientific innovation and research needed by the country.

Bush proposed that the U.S. government continuously provide a large amount of funds to facilitate cooperation between universities and private enterprises to create "post-war innovation machines." In 1944, the "Veterans Rights Act" expanded university enrollment and trained many engineering and technical personnel. After the nascent industry has developed, many unprecedented jobs have been created. In the following 20 years, the salaries of American middle school graduates and college graduates have increased significantly. From 1940 to 1964, the federal government's investment in research and development increased by 20 times. In the heyday of the 1960s, this expenditure accounted for about 2% of GDP, which is roughly equivalent to today's 400 billion U.S. dollars.

On the other hand, during World War II, although the US government allocated a large amount of funds to the National Defense Research Council, the National Defense Research Council was composed and led by scientists and engineers. The bureaucracy of the US government (including the military) has no right to interfere in the work of these scientists and engineers. Decide. This approach has produced good results. The various scientific innovations promoted by the National Defense Research Council have made a significant contribution to the United States in winning the Second World War.

Looking back at the history of scientific innovation in the United States during this period, the special backgrounds such as World War II and the Cold War arms race are clearly "indispensable." They have become the best reason for the generous support of investors and the government's massive funding of scientific innovation. But from a methodological point of view, the special precedents during the Second World War may not be comparable.

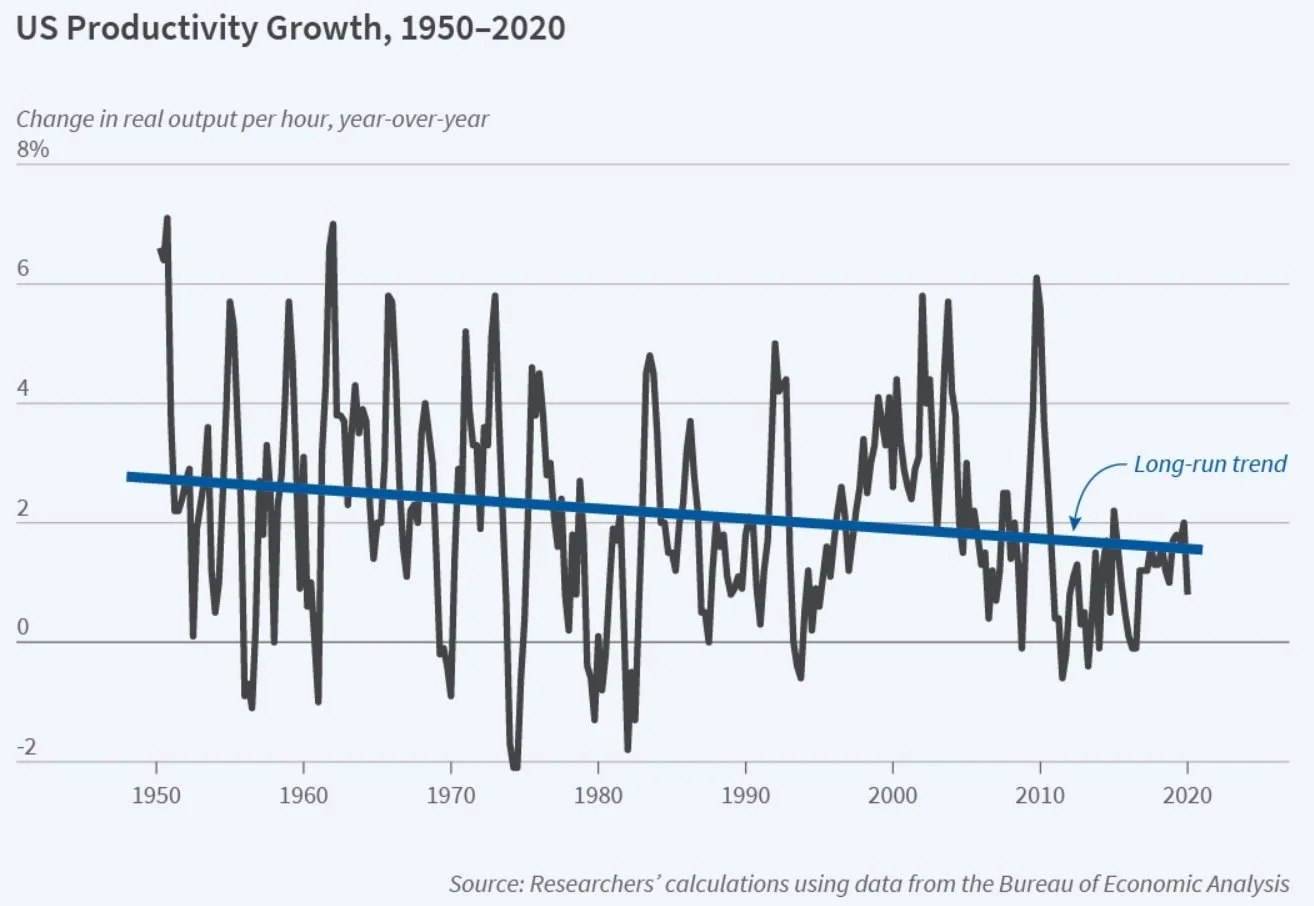

Facts have also proved that with the reduction of government support, US technological innovation has gradually entered a low ebb.

2. Scientific innovation of U.S. private companies

The innovations of US private companies such as Microsoft, Apple, Amazon, and Google have hardly received any support from the government. They are entirely self-motivating within the companies for the purpose of competition and survival. A large number of privately supported laboratories at Stanford University, Massachusetts Institute of Technology, University of Washington, University of California, and Johns Hopkins University play a very important role in basic research in the United States.

These stories are already familiar to us, but scientific innovation in private companies has not been smooth sailing—at least from the perspective of the United States.

One of the wonderful stories is how the United States missed the liquid crystal display products and handed over to Japan in the 1960s.

In 1968, researchers from RCA held a press conference to showcase the world’s first commercial LCD display—this was the beginning of the liquid crystal display (LCD), and this project was quickly planned. Belongs to the semiconductor team that holds the patent of transistor cathode ray tube (RCT).

Perhaps because of concerns that the development of LCD technology will endanger the very successful and lucrative RCT TV business and the benefits of patent licenses, all research activities on LCD screens were forced to terminate. This decision happened to give the rising Japan an excellent opportunity.

It was in this year that the Japan Broadcasting Association (NHK) went to the American Radio Broadcasting Corporation to shoot the documentary "The Company of the World: Modern Alchemy", one of which showed the LCD screen. After the show was broadcast, this emerging technology attracted the attention of many people, including Tomio Wada, who is in charge of Sharp's computer display business.

He immediately suggested: Use LCD screens to make calculators.

Subsequently, Sharp's management, who had great ambitions to transform into a high-tech industry, went to the American Radio Broadcasting Corporation in person. At that time, the American Radio Broadcasting Corporation was not enthusiastic about this technology, so it sold the patent license to Sharp at a price of 3 million US dollars.

In 1973, Sharp announced that the world's first-generation commercial pocket calculators used LCD screens.

The United States originally had a second chance to overtake.

Sharp's LCD screen uses passive matrix technology. The image is composed of rows and columns of pixels. Complex images require many rows and columns, which results in slower data signals. In addition to the active matrix processing system developed by Westinghouse scientists in the United States, the use of transistors to turn on all pixels at once makes the screen faster, brighter, and clearer.

At that time, Westinghouse did not pay enough attention to this technology. The Brody team responsible for the development of the technology left Westinghouse’s independent portal in anger. In 1984, he began to sell experimental products and laboratory prototype screens. The industry has 80 customers.

If the first time Americans missed a good opportunity, it was because of the short-sightedness of ABC, then this time, American venture capitalists did not show enough courage. They believed that Japanese companies were already in a leading position. it is too late. Finally, Brody's company failed because it was unable to achieve scale.

We all know the following story. Japan has occupied and monopolized the world market. From the mid-1990s to 2010, the scale of the industry has increased tenfold. The current global sales are 114 billion U.S. dollars, but there is no American company. Profit from this industry, and no American workers are employed in this industry.

Ironically, the US state of Wisconsin took the initiative to introduce Foxconn’s LCD factory project several years ago.

3. In the new situation, how does the US government support scientific innovation?

Although the U.S. government's funding for scientific innovation has fallen sharply after the 1970s, there are not a few companies benefiting from the U.S. government's funding, and they have also achieved remarkable results. Genome sequencing is a typical case.

In 1988, the U.S. Congress agreed to fund the National Research Institute of the United States to conduct human genome research. In 1990, the Human Genome Project was launched, which is expected to last for 15 years, with a total budget of US$3 billion. In 1999, the funded Cereira Genomics Company carried out the human genome sequencing work, and its sequencing method was a great success.

There are many government-funded companies like Cereira Genomics, which directly stimulates the development of the entire industry and drives a considerable number of jobs——

In 2004, the total value of the stock market in the genomics category was 28 billion, and 75% were publicly listed companies. Among those private companies that are not listed, 62% are based in the United States;

From 1988 to 2012, direct and indirect economic activity expenditures related to this project amounted to US$965 billion, creating 280,000 jobs and US$19 billion in personal income;

In 2012 alone, the industrial sector supported by genomic research generated US$3.9 billion in federal taxes and US$2.1 billion in state and local taxes, far exceeding the US$3 billion investment in 13 years.

On the other hand, government-funded scientific innovations have higher social returns than private returns because of the spread of technological innovation to other fields. For example, scientific innovation has driven the development of some superstar cities in the United States-the center of biotechnology is located in Cambridge, and Microsoft moved its headquarters to Seattle in 1979. This has had a profound impact on the local area.

Having said so much about the benefits of government funding for innovation, the author also makes suggestions: It is proposed that the US federal government spends 100 billion US dollars to fund scientific innovation every year, which can create 4 million jobs and share the growth opportunities of the entire country.

Based on past innovation cases, the author suggests: First, focus on the integration of research and products. The public sector and private enterprises should establish partnerships to form a good complementarity, generate better returns to compensate for possible losses caused by risky investment, and attract more More investment; the second is to extend public research funds to various places to obtain intensive benefits; the third is to create new innovation centers through competition, and formulate local regulations that are conducive to economic growth, successful infrastructure plans and education base plans, etc.; The fourth is to use an independent committee to ensure that funds are used for the most valuable research projects; the fifth is to benefit more people by sharing innovation dividends.

"A Brief History of American Innovation" does not recapitulate the glory of the past in the field of scientific innovation, but under the new scientific competition landscape, it is vocal about the lack of funding for scientific innovation by the US government, and hopes to form realistic decisions to maintain the leading edge of the United States. . As professional scholars, Jonathan Gruber and Simon Johnson also explained the internal mechanism of scientific innovation to promote economic development, and analyzed the reasons why scientific innovation improves national competitiveness. This allows readers to deeply understand the importance of scientific innovation.

However, do the heads of government and politicians of the United States have such great determination? Can they give up political disputes for the benefit of the whole country? Do U.S. taxpayers agree to pay more taxes for this?

These are obviously more important and difficult issues.

Marketing strategies in family firms

Manuel Alonso Dos Santos, Orlando Llanos Contreras, Raj V. Mahto

ABSTRACT

Branding and reputation plays an important role in determining firm behaviour and outcomes. These well-known marketing concepts have attracted attention of family firm scholars as well. However, despite the significant growth in family firm literature over the last two decades, the application of marketing theories and concepts in family firm context is limited. Thus, there is an urgent need for a better understanding of reputation, branding, communication, and marketing perspectives in family firms. The goal of this special issue is to enhance our understanding of marketing strategies in family firms.

Introduction

Family-owned firms are the most dominant form of business entities in market economies around the world (Poza & Dauguerty, 2013). For example, these firms represent 70% to 90% of all firms in Europe, 70% of all firms in the USA and Australia, and up to 98% of all firms, ac-cording to some estimates, in Latin America. In African and Middle Eastern countries, family firms play an equally important role (Basly, 2017; Llanos-Contreras & Jabri, 2019; Zellweger, 2017). Family firms are central for many countries not only from an economic perspective, but also in terms of their social role in regional development (Bas-co, 2015; Llanos-Contreras & Alonso-Dos-Santos, 2018). Prevalent in family firm literature is the attribution of their uniqueness to family ownership and family influence. Family identity is a resource that influences con-sumer behavior and their response to communicational stimulus (Alonso Dos Santos et al., 2021; Sageder et al., 2015). Thus, the family identity of a firm is a source of differentiation that can be commercially exploited (Bote-ro et al., 2019). While research based on socioemotional wealth acknowledges that these organizations are especial-ly focused on protecting their reputation and family name (Alonso-Dos-Santos & Llanos-Contreras, 2019; Berrone et al., 2010), articles utilizing the resource-based view suggest these organizations retain valuable idiosyncratic resources that impact the lives of their customers and stakeholders (Craig et al., 2008; Gallucci et al., 2015; Zellweger et al., 2010). Furthermore, empirical findings confirm the positive benefits of communicating the family control of the firm to firm stakeholders, such customers, employees, and the local community (Deephouse & Jaskiewicz, 2013).The aforementioned economic and social impor-tance of family firms, when combined with the significant communication and marketing potential of a firm being acknowledged as family owned, creates a rich area for scholarly exploration. Some progress achieved in the area more recently includes: (1) understanding the strategies em-ployed by family firms to communicate their family compo-nent/identity through websites (Botero et al., 2013; Mice-lotta & Raynard, 2011), (2) identifying factors impacting firm image and types of strategic actions enhancing their family brand (Binz et al., 2013; Marques et al., 2014), and (3) assessing consumer response to firm communications emphasizing family nature, such as signals through a firm’s product packaging (Alonso-Dos-Santos et al., 2019; Beck & Prügl, 2018; Lude & Prügl, 2018).

Family firms’ branding and reputation has attracted family firm scholars’ attention in recent years. However, the application of marketing theories to family firms has witnessed a slow progress in academic journals. There is an acute scholarly need for understanding the reputation man-agement of family firms and how to make the most of it from a branding, communication, and marketing perspec-tive. Accordingly, articles in this special issue have been selected because of their contribution in making progress on this theme. This special issue is publishing five articles, which present the work from twelve scholars from five different countries and nine different universities. The articles address issues related to customer-family business relationships, perceptions of family businesses and customer behavior (purchase intention), risk aversion and marketing collab-oration with other businesses, digital marketing strategies for family businesses and reputation and family identity. In terms of methods, most of them are based on quantitative data analysis with one using regression analysis and two others utilizing structural equation analysis. One article is based on a mixed research design and one is a systematic literature review.

Discussion and Contributions

The article by Cuevas-Lizama, Llanos-Contreras and Alonso-Dos Santos entitled, “Reputation and identity in family firms: Current state and gaps for future research” ex-plores the strategic value of reputation and the transmission of a family firm’s family identity. This research uses a sys-tematic literature review approach, studying 56 articles in-dexed in the Web of Science database, to analyze the current state and evolution of the topic, the impact it has had in re-cent years, and to identify relevant research areas with their respective contributions and research gaps to guide future work. The analysis of this work reflected seven research topics related to reputation and family image, finding great-er relevance in works that analyze the sources of advantages of the reputation of family businesses and how the priority to preserve it influences their strategic behaviors such as investments in R&D and their socially responsible activi-ties. Other papers found in this article advance study themes that the transfer of family identity effects both in financial markets, where family firms seek to be transparent in order to take care of their image, and in the consumer market, where they have a better response compared to non-family firms. Finally, this work highlights opportunities for future research by considering other less studied areas that detail how family firms transmit family identity to internal groups, the diffusion strategies they have with external groups, and the effects of reputation on performance.

Botero and Litchfield-Moore make contributions by as-sessing the perception about family firms. Based on signal-ling theory and the theory of reasoned action, the authors predicted that the family identity would be a signal which determines consumers’ perceptions, attitude, and intention to buy in relation to family firms. This research included four studies to respond to the question “What are the as-sociations that customers have with products and services from “family-owned businesses”? Study 1 was based on the analysis of qualitative data from a four-question survey to 87 students from introductory courses. Study 2 considers data collected from a 73 item survey which was responded to by 145 college students. Items in this survey allow the quantitative assessment of perceptions about family firms, attitude toward these organizations and intention to buy and work for these firms. Study 3 included additional respons-es from another 90 college students. Unlike Study 2, here questions on intention to buy and intention to work were asked to different groups to make the survey shorter and easier to answer. Finally, Study 4 was focussed on exploring the generalizability of their previous results and included 65 working professionals (in addition to 54 new students) in the sample. Results are in line with research suggesting that communicating the family identity of a firm would re-sult in a positive response from consumers (Alonso Dos Santos et al., 2021). Botero and Litchfield-Moore confirm that “family-owned businesses” would have an advantage in using their identity as part of their communication and marketing strategies. Results suggest that consumers would have positive perceptions about organizational values and neutral perceptions about products and services offered by family firms. The authors concluded that “As suggested by the Theory of Reasoned Action, these perceptions affected attitudes and intentions towards Family Owned Business.”The work from Gonzalez-Lopez, Buenadicha-Mateos, Barroso and Sanguino deals with the theme of digital mar-keting strategies in family firms. More specifically, the au-thors analyse the online presence and differences between Ibero-American and American family firms in the world. Based on information provided by the Family Business Global Index (FBGI), this article aimed to respond to the following two research questions: (1) Does the quality of a corporate website and the presence in social networks in-fluence the family firm’s turnover? and (2) Are there sig-nificant differences between Ibero-American and American family firms regarding online presence, in terms of quality of corporate websites and presence in social networks? The article analyses content, form, function and presence in so-cial networks. This work is important because the profound influences of social networks and internet in communica-tion and marketing strategies in all the different econom-ic sectors around the world (Alonso Dos Santos, Calabuig Moreno, Crespo et al., 2016; Alonso Dos Santos, Calabuig Moreno, Rejón Guardia, et al., 2016). Internet is not only the one of main and more accessible communication chan-nels for large and small businesses, but also it offers a wide range of options to develop flexible and focused marketing strategies. Among other findings, this article results show that there is a negative relationship between website quality and company turnover and a positive relationship between social networks and company turnover. This is important for family firms because it provides insight into the effec-tiveness of different communication channels and strategies they have access to. Also, the study did not find significant differences among the family firms of the two regions with respect to online presence, which suggests similar availabil-ity of this resource in both regions. Thus, this work con-tributes to the specific topic of our special issue by mak-ing progress in the understanding of marketing strategies in family firms. The article also makes progress in family firm literature, by integrating concept and construct from the marketing research. From a managerial view point their findings are important as they shed light on the importance of enhancing family firms’ online presence, and the power of building strong family firm brands based on this online presence.

The article entitled, “Personalized Service and Brand Equity in Family Business: A Dyadic Investigation of How Family Business Owners’ Time Servicing Customers Im-pacts Work Overload: Spillover Effects in Delivering a Per-sonalized Service and in Building Brand Equity” by Velas-co, Lanchimba, Llanos-Contreras and Alonso-Dos Santos focused on the understanding of demand and resources on the firms’ brand equity. More specifically, this research fo-cused on answering the question of (1) how family busi-ness owners’ time in serving customers, work overload, and Collaborative Organizational Citizenship Behaviours inter-act and influence the delivery of personalized services in Small and Medium size Family Enterprises, and, (2) how these relationships ultimately influence these firms’ brand equity. In this way, the article made progress on the under-standing of how family business owners’ time in servicing customers triggered a chain of effects (positive and nega-tive) which finally impacted on small and medium family enterprises’ brand equity. The authors’ study is highly im-portant and relevant because brand equity is closely related to corporate reputation and accordingly, it would not only be a good way to assess reputation in family firms, but also to understand factors that enhance or harm it. This is par-ticularly important in family firms as the firm reputation is closely tied to the family reputation and it is one of the most salient socioemotional wealth priorities (Deephouse & Jaskiewicz, 2013; Llanos-Contreras & Alonso-Dos-Santos, 2018). The findings in this article are relevant and make an important contribution to theory and practice. From a theo-retical viewpoint, the study sheds a light on the connection between brand equity and firm reputation. It is important as it suggested that brand equity would be a good proxy to assess reputation in family firms. Theoretical contributions are made also to marketing and reputation theory in family firms by integrating the analysis of resources and process to reputation theory. In this way this article goes beyond the analysis of the sole effect of communicating the fam-ily identity and integrates the study of the process which is central in the marketing strategy. From a practical view-point, family-business managers can learn by identifying strategic resources and processes that influence their firms’ brand equity and ultimately the family and firm reputations. Controlling these resources and process would be central for managers in order to preserve their firm and family rep-utation.

Ibáñez’s paper, “Inter-firm marketing collaboration in family businesses: The role of risk aversion”, explores how risk aversion in family firms influences their non-fi-nancial strategic decisions to collaborate in marketing. This research addresses two issues barely explored in the fami-ly firm literature: (1) the influence of risk aversion on the decision to collaborate to develop marketing capabilities and (2) the choice of a partner known or unrelated to the family firm for this cooperation. The author proposes that both decisions are made simultaneously. She uses a bivar-iate probit method to evaluate the decision to enter into a collaborative relationship and the choice of a partner in a single econometric model. Results suggest that family firms that are more conservative in terms of risk-taking are less willing to engage in collaborative relationships for market-ing activities. However, these firms are willing to take a risk by collaborating with a partner they do not know (rather than a known partner). This apparent dichotomy is consis-tent with previous research showing that family firms are both risk-taking and risk-averse in order to preserve socio-emotional wealth (Gómez-Mejía et al., 2007). In this case, socioemotional preservation would not only be related to risk-taking decisions, but also to their priority of preserv-ing good standing with people they have close relationships with by avoiding engaging in partnership with them. This article contributes to family business research by extending the study of risk aversion beyond the financial and econom-ic decisions of family firms. Concluding ThoughtsIn summary, this issue of Journal of Small Business Strategy is a special issue on “Marketing strategies in fam-ily firms”. The five works in this special issue significantly enhance our understanding of family firm reputation from a strategic marketing viewpoint. The studies in the special issue contribute to reputation theory in family firms, as well as to knowledge in marketing and communicational strate-gies for these specific types of organizations. The articles in this issue allow the readers to know the state of the art from a theoretical viewpoint, but also to analyse empirical find-ings in relation to the effect of communicating the family firm identity, the influence of family identity in the world wide web, the importance of small and medium family firms’ resources and demand in building brand equity, and the importance of risk-taking aversion toward collaboration on developing marketing capabilities. From a managerial perspective, this special issue provides important insight for family firm owners and managers in relation to the im-pact of leveraging their family identity in their marketing strategies. Also, practitioners can learn about mechanisms, processes and resources which would drive the successful implementation of such strategies in these firms.

What Makes Capitalism Tick?

By Arnold Kling

Understanding the market process as a systematic, error-corrective sequence of profit-inspired entrepreneurial discoveries, continually reshuffled and redirected as a result of the ceaseless impact of exogenous changes, should drastically alter our appreciation of key features of capitalism.

—Israel M. Kirzner, Competition, Economic Planning, and the Knowledge Problem

This volume of the collected works of Israel M. Kirzner, edited with a modestly brief introduction by Peter J. Boettke and Frederic Sautet, addresses deep and important questions that most economists would rather skip. These pertain to what distinguishes market activity from central planning, the economic role of entrepreneurs, and what is meant by competition.

I found the conceptual issues that Kirzner raises to be intellectually challenging, and so I imagine that many readers will as well. If you pick up the book, I recommend starting near the back with the essay “How Markets Work: Disequilibrium, Entrepreneurship, and Discovery,” in order to get a general overview before you tackle the essays from the beginning.

Here, I will focus primarily on the question of what distinguishes a market economy from a centrally planned economy. While my discussion is informed by Kirzner’s writing, I do not claim to completely understand or share his views.

In a market economy, decisions about what to produce and how to produce are made by individual entrepreneurs. In order for entrepreneurs to do this in a way that promotes more efficient economic outcomes:

1. They must be guided by a profit incentive.

2. They must compete in a never-ending process in which they correct mistakes and seize opportunities for improvement.

Many economists believe that the main weakness of socialism is the absence of a profit incentive. But Kirzner writes,

Our further exploration of the interface between the economics of socialist calculation and the economics of the process of entrepreneurial competition will permit us to argue, I believe, that there are analytical grounds for maintaining that the Misesian “problem of knowledge” is indeed anterior to [the] problem of motivation. (page 151)

The problem of knowledge is to discover what consumers want and how to efficiently provide for those wants. Entrepreneurial competition is a process for making such discoveries. In the absence of such competition, the central planner must rely on guesswork.

In a socialist economy, the planner lacks a means for obtaining information on what individuals want. Kirzner point out that, conversely, a market economy has no concept of what “society” wants.

A market economy is by definition made up of a multitude of independently-made individual decisions. In such a context to talk of decisions made “by society” is, at best, to engage in metaphor. “Society” does not, as a simple matter of fact, choose; it does not plan; it does not engage in the “allocation of resources”; it does not have ends; it does not have means; to talk of society facing “its” allocative, economizing problem is, strictly speaking, to talk nonsense. (pages 153-154)

Those of us who wish to defend both methodological individualism and markets are faced with a paradox. When we say that the economy works well, we are claiming to speak for the entire society. But as individualists, we would say that there is no such moral entity as “society.”

My way of dealing with the paradox is to say that I have my intuition about what constitutes a “good economic outcome for society,” and you have yours. If our intuitions have little or nothing in common, then we have no basis for further discussion. But if our intuitions are similar, then we can have a productive dialogue about what sort of institutional arrangements are likely to produce desirable outcomes relative to our respective intuitions.

“For background on these topics, see Socialism,, by Robert Heilbroner; Austrian School of Economics,, by Peter J. Boettke; and the biography of Leon Walras in the Concise Encyclopedia of Economics.

For more writings by Israel Kirzner, The Economic Point of View and Edwin G. Dolan (ed), The Foundations of Modern Austrian Economics.”

During the “socialist calculation debate,” economists who advocated socialism conceded that the price mechanism performs an essential information-processing function. They suggested, however, that a government bureau (today we would say a powerful computer) could store a list of all of the economy’s inputs and outputs. Call this the WAC, for Walrasian-Auctioneer Computer. The WAC would then propose a set of prices for inputs and outputs. Consumers would decide on their demands, and firms would decide on outputs. The WAC would look at the results to see what shortages or surpluses emerged. For inputs or outputs that are in surplus, the WAC would adjust prices downward. For inputs and outputs that are in shortage, the WAC would adjust prices upward. Then it would allow consumers and firms to respond to this new set of prices, and look at those results. This process would continue until all surpluses and shortages were eliminated.

In fact, the process just described is problematic, because the economic activity that takes place at “false prices” in one iteration might alter the desired activity at a subsequent iteration. It by no means guarantees smooth convergence to the point where all markets are in balance.

An alternative is to have the WAC announce a set of prices but not allow trading to take place. Instead, the WAC asks everyone to report what they wish to trade at those prices. Based on these wishes, the WAC looks at the resulting surpluses and shortages as hypothetical. It proposes a new set of prices to eliminate these hypothetical shortages, and everyone reports what they wish to trade at these new prices. Assuming that this iterative process converges to a balanced solution, the WAC finally allows trading to take place at the market-clearing set of prices.

Some remarks about this hypothetical WAC mechanism:

1. Most mainstream economists, whether they favor socialism or not, do not worry about whether or not the WAC mechanism exists or is feasible. The standard approach is to construct economic models that assume that the economy works “as if” it used the WAC mechanism. In particular, it can be taken for granted that the economy will adjust to equilibrium states. Therefore, the task of the economist is to analyze the properties of equilibrium states and to compare one such state with another.

2. In contrast, Kirzner and other Austrian economists insist on the importance of the fact that the WAC mechanism does not exist in the real world. In the real world, central planners make their dictates using guesswork, not by using databases and trial-and-error prices. Kirzner points out that in a real-world market economy, entrepreneurs take on the task of adjusting prices and identifying opportunities to alter the mix of what is produced and how it is produced. A computer does not identify shortages, surpluses, and opportunities. Individual entrepreneurs find them.

What Kirzner calls “entrepreneurial alertness” is what grinds down inefficiencies and drives the economy in the direction of equilibrium, or market balance. Of course, the economy never actually reaches such a state, because new opportunities to improve efficiency always arise as events take place and new discoveries emerge.

3. Even if the WAC mechanism were technically feasible, I believe that it still would not be sufficient to facilitate a socialist economy. We would still be missing the element of “entrepreneurial alertness.” It is one thing to believe that a factory manager could decide how many compact cars and how many mid-size cars to produce, based on prices proposed by the WAC. But who has responsibility for coming up with the idea of a ride-sharing service? Or a self-driving car? That is neither the job of the WAC nor the car manufacturer. In addition to the WAC, would-be market socialists need a cadre of designated innovators, whose job it is to generate new products and processes.

4. I think this still leaves open the question of how to motivate firm managers and others in a socialist economy. You can tell a manager to adjust production to maximize a profit that is purely an accounting device, with no effect on remuneration. But what incentive will that provide to managers? And will designated innovators take the right risks if they are playing the game for tokens that are not real money?

5. While all of these arguments point to the difficulty of central planning, this leads to the question: how do firms manage to operate? Within a firm, activities are not guided by a price system and entrepreneurial alertness. Instead, like a central planner, the boss sets internal prices, notably the compensation rules for its workers. Like a central planner, the boss chooses projects based on informed hunches rather than leaving the selection to a market mechanism.

““Can advocates for socialism point to Wal-Mart or Apple Computer as proof that central planning can work?””

Skeptics of socialism like to point to North Korea or the former Soviet Union as proof that central planning fails. But can advocates for socialism point to Wal-Mart or Apple Computer as proof that central planning can work?

I would say that the difference between Wal-Mart or Apple on the one hand and North Korea or the former Soviet Union on the other is that when central planning breaks down at one of these entities, the ineffective firm will be weeded out and replaced much more quickly than the ineffective socialist government.

If we think of the firm as a locus of central planning, then a market economy consists of these planned enterprises, jostling with one another. We might use a metaphor of ships that are centrally managed, some large and some small, all trying to stay afloat in a sea of competition. Corrosion and natural disasters frequently sink some of the ships, but other ships arrive, and people’s lives generally get better because these ships are new and improved. A centrally planned economy is a like a single structure sitting on dry land. It is less likely to experience rapid improvement, and when it corrodes or is hit by a natural disaster, its population suffers for a long time.

Drop Your Intellectual Defenses

By Arnold Kling

When your views are challenged by a discordant observation or a person with a different opinion, should you treat this as an opportunity to reconsider or as a threat to fight off? Julia Galef argues for the former.

Galef favors what she terms the scout mindset, which means adjusting your outlook to take new information into account. She contrasts this with what she calls the soldier mindset, which means ignoring or dismissing new information in order to keep your current outlook intact.

According to Galef, the intellectual scout uses reasoning to try to map reality. The scout welcomes contrary information as helping to correct this map. The soldier uses reasoning to defend one’s map of reality. The solider fights contrary information as if to stave off defeat.

Scout mindset has a number of advantages. One makes better predictions and decisions by seeking the truth. One is actually more persuasive to others, because people value honest assessment rather than overconfidence.

This raises the question of why the soldier mindset evolved in the first place. Galef lists several psychological factors that make it appealing.

First, challenges to our worldview make us uncomfortable. Dismissing such challenges relieves the discomfort, at least for a while.

We are inclined to tune our beliefs in order to protect our self-esteem. For example, if we have trouble learning a foreign language, it is easier to insist that knowing foreign languages is unimportant than to undertake the effort needed to attain that skill.

When we make a decision, considering alternatives may create anguish. Closing our minds to those alternatives may allow us to feel better about our choice, at least for a while.

Being firm in our beliefs can help us to get others to comply with our wishes. But note that this creates the risk that when others defer to our soldier mindset, they do so reluctantly, lacking our same conviction. Galef cites a study in which

… law students who are randomly assigned to one side of a moot court case become confident, after reading the case materials, that their side is morally and legally in the right. But that confidence doesn’t help them persuade the judge… [they] are significantly less likely to win the case—perhaps because they fail to consider and prepare for rebuttals to their arguments. (p. 27)

Galef points out that one’s beliefs can serve as a sort of fashion statement.

Psychologists call it impression management, and evolutionary psychologists call it signaling: When considering a claim, we implicitly ask ourselves, “What kind of person would believe a claim like this, and is that how I want other people to see me?” (p. 23)

A related motive for holding some beliefs is to fit in better with one’s social group. This can be a particularly powerful motive when a group is strict about excommunicating heretics.

“The more that we are convinced of our own objectivity, the less likely that we are operating in scout mindset.”

One of Galef’s interesting themes is that we self-deceive about our mindset. The more that we are convinced of our own objectivity, the less likely that we are operating in scout mindset. In fact, one key to remaining in scout mindset is the willingness and ability to recognize one’s own inclination to fall back on soldier mindset. As she puts it,

But the biggest sign of scout mindset may be this: Can you point to occasions in which you were in soldier mindset? (p. 57)

In particular, having high intelligence and a good education is no assurance that one has scout mindset. On the contrary, it makes one better able to operate using soldier mindset and to hang on to incorrect views.

Galef believes that one acquires scout mindset by cultivating certain habits. These include making a point of telling other people when they have helped you to change your mind, genuinely welcoming feedback, and subjecting your own beliefs to rigorous examination.

Galef advocates using thought experiments as a way of escaping from soldier mindset. For example, in deciding whether to continue or quit a project, she proposes an “outsider test,” in which you imagine what another person would do if they were suddenly dropped into your situation. This thought experiment could relieve you of the baggage of your previous actions that got you into the predicament. The outsider test may also make it easier to avoid throwing good money after bad or wasting time continuing to pursue a graduate degree that no longer seems as worthwhile as when you started.

Another interesting thought experiment is to ask whether your opinion would change if an influential person were to change their mind. For example, suppose that during a meeting the boss advocates a particular project. Before you decide whether or not you agree, imagine what your thinking would be if the boss were to oppose the project.

For acquainting yourself with diverse viewpoints, it pays to choose carefully who you pick to represent that viewpoint. If you only pay attention to the worst people on the other side, then this will serve to close your mind rather than open it.

To give yourself the best chance of learning from disagreement, you should be listening to people who make it easier to be open to their arguments, not harder. People you like or respect, even if you don’t agree with them. People with whom you have some common ground—intellectual premises, or a core value that you share—even though you disagree with them on other issues. People whom you consider reasonable, who acknowledge nuance and areas of uncertainty, and who argue in good faith. (p.171)

Galef suggests that one good habit is to cultivate friends who model the scout mindset.

One of the biggest things you can do to change your thinking is to change the people you surround yourself with. We humans are social creatures, and our identities are shaped by our social circles, almost without our noticing. (p. 219)

For more on these topics, see the EconTalk episode Julia Galef on the Scout Mindset and “Tribal Psychology and Political Behavior,” by Arnold Kling, Library of Economics and Liberty, August 6, 2018. See also the EconTalk episode L.A. Paul on Vampires, Life Choices, and Transformation.

When we raise the level of analysis from the individual to the group, this leads me to think of another reason that the soldier mindset survives. At an individual level, self-skepticism may be a useful characteristic. But at a group level, rewarding loyalty and stifling dissent may have survival value, at least up to a point. A society where “anything goes” could lose out to a society that demands sacrifice and a strong community-oriented ethic from its members.

From an individual perspective, treating challenges to one’s beliefs as an opportunity rather than a threat might be a good strategy. But from a group perspective, it may pay off to be less truth-seeking and more conformity-demanding. I suspect that this tension between what is best for the individual and what promotes group survival may be at the heart of why soldier’s mindset is difficult to leave behind.

Anti-monopoly regulation falls a heavy hammerThe long-maligned exclusive copyright of online music ceases

Meng Yanbei

On July 24, 2021, the State Administration of Market Supervision and Administration issued an administrative penalty decision against Tencent Holdings Co., Ltd. (hereinafter referred to as Tencent)’s acquisition of equity in China Music Group for illegally implementing operator concentration, and ordered Tencent and its affiliates to lift exclusive copyrights and stop high Payment methods for copyright fees such as prepayments, etc., will restore the state of market competition. The case directly hits the "competitive pain points" of the online music broadcasting platform market in China, focusing on breaking exclusive copyrights and stopping high-prepayment copyright fees, ending the most-favored-nation treatment clause, reshaping the relevant market competition pattern, and continuing to play a role in my country's online music industry. Healthy development will have far-reaching impact. It not only demonstrates the attitude and determination of China's anti-monopoly law enforcement agencies to resolutely maintain fair competition in the platform economy, but also has a very important symbolic significance for the development of China's anti-monopoly law enforcement.

1. Release of regulatory dividends, and take necessary measures to restore competition to the concentration of business operators after illegal implementation for the first time

This case is the first case in which necessary measures have been taken to restore the market competition order after the implementation of the Anti-Monopoly Law. The anti-monopoly review of the concentration of business operators is an important institutional arrangement to avoid competition damage and prevent market monopoly from the source. Operators are obliged to report to the anti-monopoly law enforcement agency in a timely manner for the concentration that meets the reporting standards. If they fail to declare the illegal implementation of the concentration in accordance with the law, they shall bear corresponding legal liabilities. Article 48 of my country’s “Anti-Monopoly Law” clearly stipulates that “Where operators implement concentration in violation of the provisions of this law, the Anti-Monopoly Law Enforcement Agency of the State Council shall order them to stop the concentration, dispose of shares or assets within a time limit, transfer business within a time limit, and take other necessary measures. To restore to the state before the concentration, a fine of less than 500,000 yuan can be imposed."

Since the end of 2020, the State Administration of Market Supervision has imposed penalties on a number of platform companies’ illegal implementation of operator concentration, warning companies engaged in operator concentration to strengthen anti-monopoly compliance management, declare operator concentration in accordance with the law, and maintain a good market competition pattern. . It can be seen from the “Administrative Punishment Decision” in this case that after the concentration occurred, the market share of relevant entities increased after the concentration, copyright resources were further integrated, major competitors in the relevant market decreased, market concentration increased, and market entry barriers for online music broadcasting platforms Improved, consumer welfare may be harmed. The General Administration of Market Supervision fully assessed the impact of the transaction on market competition from the relevant market share, control, concentration, and the impact of the concentration on market entry and consumers of the operators participating in the concentration, and determined that this case has an impact on online music broadcasting in China The platform market has or may have the effect of eliminating or restricting competition.

In order to restore fair competition in the market order, the State Administration for Market Regulation has accurately applied the provisions of Article 48 of the Anti-Monopoly Law and ordered Tencent and its affiliates to not reach or in disguise reached exclusive copyright agreements or other exclusive agreements with upstream copyright parties. Require or disguisely require the upstream copyright party to give the parties better conditions than other competitors, not to increase the cost of competitors in disguised form by means of high advance payments, eliminate or restrict competition, and propose to Tencent to declare the concentration of operators in accordance with the law and operate in compliance with laws and regulations. Clear requirements. This is the biggest highlight of this case and the greatest significance of the punishment decision in this case. It fully embodies the market thinking and the spirit of the rule of law, and demonstrates the professionalism of anti-monopoly law enforcement agencies and their deep grasp of the laws of platform economic development.

2. Adhere to both development and standardization, and build a new competitive advantage for the country

The ninth meeting of the Central Finance and Economics Committee emphasized that it is necessary to proceed from the strategic height of building a new competitive advantage of the country, adhere to both development and regulation, better coordinate development and security, domestic and international, promote fair competition, oppose monopoly, and prevent disorderly expansion of capital . The platform economy is a new driving force for my country's economic development. The ultimate goal of supervision and law enforcement is to further stimulate the innovation power and development vitality of platform enterprises, realize the sustained and healthy high-quality development of platform economic norms and innovation, and build a new competitive advantage for the country.

The handling of this case is the implementation and vivid embodiment of the above-mentioned principles. On the whole, the online music broadcasting platform market is still an emerging industry, and its development is in the ascendant; related companies not only need to develop and grow in the domestic market, but also need to "go out" to compete in the international market. In the choice of attaching restrictive conditions to cases of concentration of undertakings, how to solve the effects of eliminating and restricting competition brought about by mergers and acquisitions, but also to fully stimulate the innovation power of enterprises and achieve stability and long-term development, the grasp of regulatory standards is very important and a test The wisdom of anti-monopoly law enforcement agencies. In this case, the State Administration for Market Regulation did not choose structural relief measures such as "disposal of shares or assets within a time limit, and transfer of business within a time limit" when handling this case. Instead, it adopted precise behavioral relief measures, ranging from breaking exclusive copyrights and regulating copyright payment methods. Starting from a perspective, while protecting fair competition in the market and bringing strong vitality to the development of the industry, it is also conducive to maintaining the core competitiveness of the enterprise and laying a solid foundation for platform enterprises to strive for more development opportunities and a broader development stage.

3. Accurately solve the pain points of competition and reconstruct the market competition ecology of online music playback platforms

In the field of platform economy, due to its unique characteristics of cross-industry competition, dynamic competition, "winner takes all", and high agglomeration, the competitive impact of relevant behaviors is more complicated, which is a common challenge faced by global antitrust law enforcement agencies.

As the platform is a bilateral or multilateral market, the investment of resources on one side of the platform is often of great significance to the development of the platform. In the market competition of online music broadcasting platforms, copyright of genuine music is the core asset and key resource input for platform operation. A music platform that has obtained an exclusive license can decide whether to sublicense to a competitor's platform, as well as the price and scope of the sublicense, resulting in a certain degree of exclusivity for music copyright resources. Through exclusive copyright agency, Tencent has increased the transaction link for online music platforms to obtain copyrighted content, increased the cost of acquiring genuine music content on new platforms, and formed a certain degree of "raw material blockade" for other competitive platforms to obtain necessary copyrighted music content. , Has raised the market entry barriers. Therefore, when my country’s anti-monopoly law enforcement agency chose punishment and relief measures in the case of Tencent’s acquisition of equity in China Music Group’s illegal implementation of operator concentration, it took a series of necessary measures such as requiring Tencent not to reach an exclusive copyright agreement with upstream copyright parties or in disguise. Competitors in relevant markets have fair access to upstream copyright resources, and the focus of competition has been returned from irrationally grabbing copyright resources by capital advantage to innovative service levels, improving user experience on a rational track, and promoting relevant platform companies. Level competition to achieve high-quality development is of great significance. At the same time, this case retains the exclusive form for independent musicians and new song debuts, which is conducive to protecting the platform's investment enthusiasm, fostering and enriching local music, and promoting the high-quality development of my country's related cultural industries.

At the same time, my country’s online music copyright fee billing model is unreasonable and the prepayment is too high for a long time and has been criticized by the industry. At present, the method of high advance payment + income sharing is used to disguisely raise relevant market entry barriers, which is not conducive to industrial innovation and development. By attaching restrictive conditions to this case, requiring Tencent to negotiate and ask prices based on the actual usage of copyrights, it is conducive to gradually achieving the goal of “settlement of copyright fees based on actual usage” in line with international standards, and further reducing domestic platforms while maintaining fair competition in the market. Enterprises pay the burden of copyright costs to overseas copyright owners.

As analyzed above, the biggest highlight of this case is to order Tencent and its affiliates to take necessary measures to restore the state of competition in the relevant market. According to the current Anti-Monopoly Law, the fine of 500,000 yuan in this case is the upper limit of the fine for related violations. It is reported that the newly revised draft of the "Anti-Monopoly Law" has greatly increased the penalties for illegal undertakings of concentration, and will further increase the penalties for such violations after it is announced and implemented.

4. Pay attention to the market competition in the platform economy and continue to strengthen anti-monopoly supervision and law enforcement in the platform economy

The platform economy has become the world's most important business model and new economic form, and has triggered the "digital butterfly change" in various fields of economy and society. The super platform has grown rapidly, has a huge scale, and has a wide range of business, which is changing people's social life and economy. Life, with strong social mobilization ability and social order shaping ability, while bringing efficiency improvement and consumer welfare to society, it may also bring a series of clear or potential risks such as damage to personal privacy. Among them, competition The issue of risk regulation has aroused global attention. For example, on July 9, 2021, the United States issued an executive order aimed at establishing a "full government" mechanism to strengthen economic competition and prevent anti-competitive behavior in the technology industry and other industries. What’s notable is that the executive order specifically emphasizes the use of anti-monopoly laws to deal with the challenges posed by new industries and new technologies, including the rise of dominant Internet platforms, especially as they stem from continuous mergers and new technologies. Competitor acquisition, data aggregation, unfair competition, user monitoring, and the existence of network effects.

The platform has the characteristics of data as the production factor, digital technology as the support, multilaterality, openness, unique resource allocation, network effect, lock-in effect, and leverage effect. China’s anti-monopoly law enforcement agencies should be based on China’s relevant market competition and platform’s characteristics. Market power, behaviors engaged in and the impact of behaviors on competition and consumer welfare, etc., actively carry out continuous market research and market competition status research on the market where the platform is located, and pay close attention to the behaviors that the platform engages in that may generate competition risks, especially for Stifling mergers and acquisitions of start-ups, etc.

At the same time, my country’s anti-monopoly law enforcement agencies should also track and evaluate the follow-up effects of typical anti-monopoly cases in the field of platform economy to determine the impact of anti-monopoly penalties on the market, and evaluate the relief and penalties taken by the anti-monopoly law enforcement agencies for violations The subsequent impact of the measures on market competition and the impact on the development of the industry, in order to further enhance the scientificity and accuracy of anti-monopoly supervision and enforcement, promote the continuous improvement of anti-monopoly legislation, enforcement and competition compliance in the field of platform economy in my country, and prevent capital loss Orderly expand, and promote the healthy and sustainable development of the platform economy. ( The author is a professor at Renmin University of China Law School and a member of the Expert Advisory Group of the Anti-Monopoly Committee of the State Council )

The State Administration for Market Regulation, Ordering Tencent Holdings Co., Ltd. to lift the exclusive copyright of online music and other penalties in accordance with the law .

In January 2021, the State Administration of Market Supervision filed an investigation into Tencent Holdings Co., Ltd.'s (hereinafter referred to as Tencent) acquisition of shares of China Music Group in July 2016 for allegedly illegally implementing operator concentration.

The General Administration of Market Supervision, in accordance with the Anti-Monopoly Law, ascertains the fact that this transaction is illegally implementing concentration, and fully evaluates the relevant market share, control, concentration, and the impact of concentration on market entry and consumers of the operators participating in the concentration. At the same time, it has extensively solicited opinions from relevant government departments, industry associations, experts and scholars, and competitors in the industry, and has listened to Tencent's opinions on many occasions.

The investigation shows that the relevant market in this case is the online music broadcasting platform market in China. The copyright of genuine music is the core asset and key resource for the operation of the online music broadcasting platform. In 2016, Tencent and China Music Group accounted for about 30% and 40% of the relevant market respectively. Tencent obtained a higher market share by merging with major competitors in the market. After the concentration, the entity owns more than 80% of the exclusive music library resources. Has the ability to urge upstream copyright parties to reach more exclusive copyright agreements with them, or require them to be given better trading conditions than their competitors, and may also have the ability to increase market entry barriers through copyright payment models such as high advance payments, and have or It may have the effect of eliminating or restricting competition.

In accordance with Article 48 of the Anti-Monopoly Law and Article 57 of the “Interim Provisions on the Review of Concentration of Undertakings”, the State Administration for Market Regulation has made an administrative penalty decision in accordance with the law, ordering Tencent and its affiliates to adopt 30 Measures to restore the state of market competition, such as the removal of exclusive music rights within days, the suspension of payment methods for copyright fees such as high prepayments, and the prohibition of asking upstream copyright parties to give them conditions superior to their competitors without justifiable reasons . Tencent will report to the State Administration of Market Supervision on the performance of its obligations every year for three years, and the State Administration of Market Supervision will strictly supervise its implementation according to law.

This case is the first case in which necessary measures have been taken to restore market competition since the implementation of China’s anti-monopoly law . Ordering Tencent to lift its exclusive copyright and other measures will reshape the relevant market competition order, lower market entry barriers, and provide competitors with fair access to upstream copyright resources, which is conducive to returning the focus of competition from using capital advantages to grab copyright resources to innovation Service levels and improve user experience are on the rational track; it is conducive to promoting a reasonable way to calculate copyright fees in line with international standards and reducing downstream operating costs; it is conducive to cultivating new market entrants and creating a fairer competitive environment for existing companies to ensure Consumers’ right to choose will ultimately benefit consumers and promote the healthy development of the online music industry’s normative innovation.

More news >>

Anti-monopoly regulation falls a heavy hammer

The long-maligned exclusive copyright of online music ceases

Meng Yanbei

On July 24, 2021, the State Administration of Market Supervision and Administration issued an administrative penalty decision against Tencent Holdings Co., Ltd. (hereinafter referred to as Tencent)’s acquisition of equity in China Music Group for illegally implementing operator concentration, and ordered Tencent and its affiliates to lift exclusive copyrights and stop high Payment methods for copyright fees such as prepayments, etc., will restore the state of market competition. The case directly hits the "competitive pain points" of the online music broadcasting platform market in China, focusing on breaking exclusive copyrights and stopping high-prepayment copyright fees, ending the most-favored-nation treatment clause, reshaping the relevant market competition pattern, and continuing to play a role in my country's online music industry. Healthy development will have far-reaching impact. It not only demonstrates the attitude and determination of China's anti-monopoly law enforcement agencies to resolutely maintain fair competition in the platform economy, but also has a very important symbolic significance for the development of China's anti-monopoly law enforcement.

1. Release of regulatory dividends, and take necessary measures to restore competition to the concentration of business operators after illegal implementation for the first time

This case is the first case in which necessary measures have been taken to restore the market competition order after the implementation of the Anti-Monopoly Law. The anti-monopoly review of the concentration of business operators is an important institutional arrangement to avoid competition damage and prevent market monopoly from the source. Operators are obliged to report to the anti-monopoly law enforcement agency in a timely manner for the concentration that meets the reporting standards. If they fail to declare the illegal implementation of the concentration in accordance with the law, they shall bear corresponding legal liabilities. Article 48 of my country’s “Anti-Monopoly Law” clearly stipulates that “Where operators implement concentration in violation of the provisions of this law, the Anti-Monopoly Law Enforcement Agency of the State Council shall order them to stop the concentration, dispose of shares or assets within a time limit, transfer business within a time limit, and take other necessary measures. To restore to the state before the concentration, a fine of less than 500,000 yuan can be imposed."

Since the end of 2020, the State Administration of Market Supervision has imposed penalties on a number of platform companies’ illegal implementation of operator concentration, warning companies engaged in operator concentration to strengthen anti-monopoly compliance management, declare operator concentration in accordance with the law, and maintain a good market competition pattern. . It can be seen from the “Administrative Punishment Decision” in this case that after the concentration occurred, the market share of relevant entities increased after the concentration, copyright resources were further integrated, major competitors in the relevant market decreased, market concentration increased, and market entry barriers for online music broadcasting platforms Improved, consumer welfare may be harmed. The General Administration of Market Supervision fully assessed the impact of the transaction on market competition from the relevant market share, control, concentration, and the impact of the concentration on market entry and consumers of the operators participating in the concentration, and determined that this case has an impact on online music broadcasting in China The platform market has or may have the effect of eliminating or restricting competition.

In order to restore fair competition in the market order, the State Administration for Market Regulation has accurately applied the provisions of Article 48 of the Anti-Monopoly Law and ordered Tencent and its affiliates to not reach or in disguise reached exclusive copyright agreements or other exclusive agreements with upstream copyright parties. Require or disguisely require the upstream copyright party to give the parties better conditions than other competitors, not to increase the cost of competitors in disguised form by means of high advance payments, eliminate or restrict competition, and propose to Tencent to declare the concentration of operators in accordance with the law and operate in compliance with laws and regulations. Clear requirements. This is the biggest highlight of this case and the greatest significance of the punishment decision in this case. It fully embodies the market thinking and the spirit of the rule of law, and demonstrates the professionalism of anti-monopoly law enforcement agencies and their deep grasp of the laws of platform economic development.

2. Adhere to both development and standardization, and build a new competitive advantage for the country

The ninth meeting of the Central Finance and Economics Committee emphasized that it is necessary to proceed from the strategic height of building a new competitive advantage of the country, adhere to both development and regulation, better coordinate development and security, domestic and international, promote fair competition, oppose monopoly, and prevent disorderly expansion of capital . The platform economy is a new driving force for my country's economic development. The ultimate goal of supervision and law enforcement is to further stimulate the innovation power and development vitality of platform enterprises, realize the sustained and healthy high-quality development of platform economic norms and innovation, and build a new competitive advantage for the country.

The handling of this case is the implementation and vivid embodiment of the above-mentioned principles. On the whole, the online music broadcasting platform market is still an emerging industry, and its development is in the ascendant; related companies not only need to develop and grow in the domestic market, but also need to "go out" to compete in the international market. In the choice of attaching restrictive conditions to cases of concentration of undertakings, how to solve the effects of eliminating and restricting competition brought about by mergers and acquisitions, but also to fully stimulate the innovation power of enterprises and achieve stability and long-term development, the grasp of regulatory standards is very important and a test The wisdom of anti-monopoly law enforcement agencies. In this case, the State Administration for Market Regulation did not choose structural relief measures such as "disposal of shares or assets within a time limit, and transfer of business within a time limit" when handling this case. Instead, it adopted precise behavioral relief measures, ranging from breaking exclusive copyrights and regulating copyright payment methods. Starting from a perspective, while protecting fair competition in the market and bringing strong vitality to the development of the industry, it is also conducive to maintaining the core competitiveness of the enterprise and laying a solid foundation for platform enterprises to strive for more development opportunities and a broader development stage.

3. Accurately solve the pain points of competition and reconstruct the market competition ecology of online music playback platforms

In the field of platform economy, due to its unique characteristics of cross-industry competition, dynamic competition, "winner takes all", and high agglomeration, the competitive impact of relevant behaviors is more complicated, which is a common challenge faced by global antitrust law enforcement agencies.

As the platform is a bilateral or multilateral market, the investment of resources on one side of the platform is often of great significance to the development of the platform. In the market competition of online music broadcasting platforms, copyright of genuine music is the core asset and key resource input for platform operation. A music platform that has obtained an exclusive license can decide whether to sublicense to a competitor's platform, as well as the price and scope of the sublicense, resulting in a certain degree of exclusivity for music copyright resources. Through exclusive copyright agency, Tencent has increased the transaction link for online music platforms to obtain copyrighted content, increased the cost of acquiring genuine music content on new platforms, and formed a certain degree of "raw material blockade" for other competitive platforms to obtain necessary copyrighted music content. , Has raised the market entry barriers. Therefore, when my country’s anti-monopoly law enforcement agency chose punishment and relief measures in the case of Tencent’s acquisition of equity in China Music Group’s illegal implementation of operator concentration, it took a series of necessary measures such as requiring Tencent not to reach an exclusive copyright agreement with upstream copyright parties or in disguise. Competitors in relevant markets have fair access to upstream copyright resources, and the focus of competition has been returned from irrationally grabbing copyright resources by capital advantage to innovative service levels, improving user experience on a rational track, and promoting relevant platform companies. Level competition to achieve high-quality development is of great significance. At the same time, this case retains the exclusive form for independent musicians and new song debuts, which is conducive to protecting the platform's investment enthusiasm, fostering and enriching local music, and promoting the high-quality development of my country's related cultural industries.

At the same time, my country’s online music copyright fee billing model is unreasonable and the prepayment is too high for a long time and has been criticized by the industry. At present, the method of high advance payment + income sharing is used to disguisely raise relevant market entry barriers, which is not conducive to industrial innovation and development. By attaching restrictive conditions to this case, requiring Tencent to negotiate and ask prices based on the actual usage of copyrights, it is conducive to gradually achieving the goal of “settlement of copyright fees based on actual usage” in line with international standards, and further reducing domestic platforms while maintaining fair competition in the market. Enterprises pay the burden of copyright costs to overseas copyright owners.

As analyzed above, the biggest highlight of this case is to order Tencent and its affiliates to take necessary measures to restore the state of competition in the relevant market. According to the current Anti-Monopoly Law, the fine of 500,000 yuan in this case is the upper limit of the fine for related violations. It is reported that the newly revised draft of the "Anti-Monopoly Law" has greatly increased the penalties for illegal undertakings of concentration, and will further increase the penalties for such violations after it is announced and implemented.

4. Pay attention to the market competition in the platform economy and continue to strengthen anti-monopoly supervision and law enforcement in the platform economy