New opportunities for scene-based development of banking institutions from the perspective of sinking markets

Yang Delin Operation and management May 11

Abstract: From the perspective of the sinking market, taking the payment and consumption capacity and branch layout capacity of banking institutions and the cooperation with the product capabilities of the same Cheng Yilong travel scene as an example, we propose planning suggestions for banking institutions in the field of business cooperation in the field of travel scenes: establish a mobile phone Bank + travel scenario ecosystem, increase diversified business consumption scenarios, and increase the activity and utilization rate of mobile banking client users of banking institutions; based on the capabilities of mobile banking and WeChat payment, use the travel scenarios of Tongcheng Yilong to create new joint credit cards and other new products, establish consumption growth target for long-term co-operations; relying on the network layout capabilities and technological innovation with the way eLong banking institutions, customers "come in" pro forma adjustments to account manager "going out" joint marketing mode , to dig deep The consumer's consumption potential of the sinking market .

I. Introduction

As of March 2020 , the number of mobile Internet users in China has reached 897 million, an increase of 79.92 million from the end of 2018 . In 2019, more users in Tier 3, 4 and 5 cities and rural areas will enter the mobile Internet , and the sinking of the market economy has become a new opportunity for the development of the mobile Internet economy.

During the 2020 epidemic, Tongcheng Yilong, represented by the travel platform , based on the marketing capabilities of the WeChat payment platform , accelerated its penetration into the sinking market, and achieved new growth in traffic. At the same time, under the impact of the Internet development wave, the online and offline businesses of banking institutions have been affected and adjusted to varying degrees. Banking institutions should seize new opportunities as soon as sinking market development, banking institutions should be recommended and with Cheng Yi Long depth cooperation , product and service iterative upgrade , in order to meet consumer needs, enhance business efficiency .

2. On the status quo and characteristics of the sinking market

(1) The definition of sinking markets: markets in cities, counties and rural areas below the third tier. It includes about 200 prefecture-level cities, 3,000 counties, and 40,000 townships. The sinking market population accounts for 72% of the population, with a population of 1.004 billion.

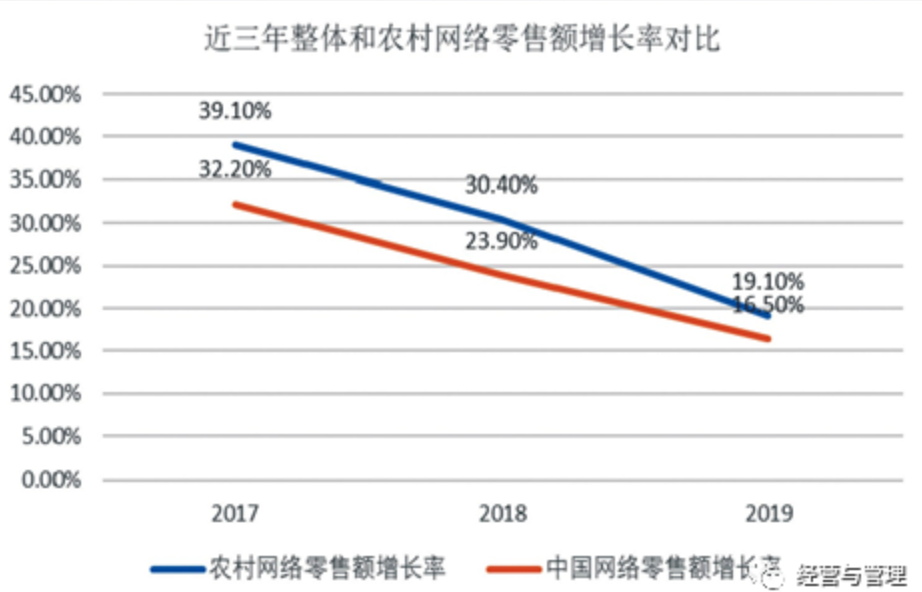

(2) The growth rate of the sinking market: 2017-2019 China's online and rural online retail sales growth rate comparison, as shown in Figure 1:

Figure 1 2017 - Retail sales growth comparison of our network and rural network in 2019

( Data source: " 2020 Sinking Market New Consumption Research Report " by Yibang Power Research Institute )

From the chart we can see 1 , in the three years 2017-2019 year, the overall growth of online retail downward trend , but our network of rural retail sales growth rate is higher than the national growth rate of overall retail sales network. The future growth opportunity of my country's online retail sales requires great attention to the development and consumption scenarios of rural online retail.

In 2020,Q2, the number of monthly active net increase in mobile Internet users in different city levels in China is shown in Figure 2:

Figure 2 The scale of monthly active net additions of mobile Internet users in different cities in China in Q2 2020

Note: The scale of monthly active net additions = the average MAU of the target user group from April to June 2020-the average MAU from April to June 2019

(Data source: QuestMobile "China Mobile Internet 2020 Semi-Annual Report")

According to Figure 2 the data found , leading the growth rate of China's retail sales network , thanks to the expansion of the sinking gauge the scale of the user market . Among them, from the perspective of cities , third- and fourth-tier cities are the main source of net increase in users.

(3) Characteristics of the sinking market

Sinking two characteristics of the market: First, the potential of sinking market size and growth of the large total of the following third-tier cities and rural areas, 1 billion people; second is the lack of quality of supply, not fully meet the needs of residents , sinking market There is still a big gap in the supply of goods and services compared with first- and second-tier cities .

Third, Tongcheng Yilong's sinking market development status

According to Tongcheng Yilong’s financial report for the third quarter of 2020, Tongcheng Yilong’s total transaction volume in the quarter was 39.7 billion yuan, achieving total revenue of 1.915 billion yuan, and total revenue increased by 59.5% from the previous quarter . Under the influence of the epidemic, Tongcheng Yilong achieved three consecutive quarters of profit .

An important factor for Tongcheng Yilong to achieve business growth in the third quarter of 2020 is its strategic layout in the sinking market in China. As of 30 September 2020 , registered users with Cheng Yi Long living in first-tier cities in China's non-registered users of the total 86.1%. The third quarter payment with Cheng Yi Long added on the micro-channel platform users about 67.2% from the domestic third-tier cities and less , and 63.3% compared to the same period in 2019 increased by 3.9%. At the transaction level, in the third quarter of 2020, Tongcheng Yilong's operation and development in low-tier cities will see a year-on-year increase of nearly 30% in hotel room nights.

Tongcheng Yilong leads the full recovery of the tourism industry , and through continuous innovation and improvement of its own technology and services , it provides consumers and users in the sinking market with a simpler and happier travel consumption experience.

4. Planning suggestions for the development of banking institutions in the sinking market travel scenario

(1) Establish an ecosystem based on "mobile banking + travel" scenarios

As soon as possible, establish an ecosystem based on the “mobile banking + travel” scenario to increase the activity and utilization rate of mobile client users of banking institutions. Banking institutions should actively embrace the digital technology capabilities of the Internet, deeply integrate the beneficial resources of their partners, and become the creators of the ecosystem. Banking institutions conform to the development trend of scenarios, seek new development opportunities through innovative cooperation with enterprises, and create a new type of cooperation and win-win financial ecosystem .

Banking institutions in the mobile banking client in, you can increase the same way eLong's travel scene goods and services, such as hotel reservation, air ticket booking, ticket, book bus tickets, etc. , both rich mobile banking itself the scene of goods and services , but also can make use of the same Cheng Yilong's strategic goal of sinking the market has created more market growth space and development opportunities for bank business operations. Mobile banking and cooperation with Cheng Yi Long product value model , shown in Figure 3:

Figure 3 The value model of product cooperation between mobile banking and Tongcheng Yilong

At the same time, the third-party payment platform is a market-oriented enterprise , and a large number of users' capital transactions and fund deposits are collected by the third-party payment platform , which may bring great risks and hidden dangers to the stability of the national financial system. But in the future to promote the use of digital currency, but they can solve the security problems caused by third-party payment platform , digital RMB applications for banking institutions in the field of payment and settlement also brings significant new opportunities.

( 2) Based on mobile banking and WeChat payment capabilities , jointly design and promote new products such as travel co-branded credit cards

With mobile banking and micro-travel scene letter ability to pay, jointly design and promote travel scene joint credit cards and other new products, establish long term of business objectives . When both mobile banking and WeChat payment are connected to travel products and services, users can increase their choice of payment consumption scenarios . Mobile banking also has a payment function . Users can use mobile banking to realize diversified services such as hotel booking, air ticket booking, balance checking, and transfer according to their own preferences.

According to business cooperation, a joint card marketing cooperation model in the mobile banking and WeChat payment scenarios is constructed, as shown in Figure 4:

Figure 4 Co-branded card marketing cooperation model in mobile banking and WeChat payment scenarios

Taking hotel reservation service cooperation as an example, banking institutions and Tongcheng Yilong can jointly design travel scenarios co-branded credit card products in two ways . The Mobile Banking entrance (micro-channel pay entrance) and hotel reservation service scenarios are summarized in the scene layer and function of ecological services layer , also unified service layer called the user's needs.

The mobile banking payments can force (micro-channel ability to pay) and co-branded cards offer pay equity into the marketing operations layer, it can be collectively called the user's payment consumer level. When the demand service layer improves user demand is triggered , the convenience of the hotel reservation portal is beneficial to the full satisfaction of users' multi-scenario demand plan , and the payment consumer layer uses joint marketing activities to enhance users' desire for consumption and lower the threshold of user consumption.

(3) A joint promotion model that transforms from "coming in" to "going out"

Relying on the branch layout ability of banking institutions and the technological innovation ability of Tongcheng Yilong, the form of customer "walking in" is adjusted to the joint marketing model of customer manager " going out " to deeply tap the consumption potential of China's sinking market.

The outlets of banking institutions are the "most expensive" channel resources of banks . Therefore , various banking institutions are also striving to seek business transformation opportunities for traditional outlets and quickly find new competitive advantages for their own development . However, the branch resources of banking institutions are irreplaceable in three aspects: one is that services such as audit nature need to be handled at the branch of the banking institution; the other is that compared with online services, the branch of banking institution can improve customer service experience. It is more deeply rooted in the hearts of the people; thirdly, the branches of banking institutions have the role of image display , which can establish bank brand information, convey brand ideas and values, and fully win the trust and satisfaction of customers.

It has a strong ability to develop the economy and user consumption potential, based at sinking the perspective of banking institutions can own network layout capabilities and team resources under line of external business cooperation and opening up , by means of scientific and technological innovation with the way eLong product enabling and development by the public Welcome new products. Outlets of the bank account manager can "go out" promotion strategy , for consumers and businesses within the network coverage to provide a wide range of goods and services, to enhance the breadth and depth of banking institutions customer service , increase user of banking institutions and with the way eLong Common brand recognition.

In order to reflect the value of marketing and banking institutions with Cheng Yi Long sinking market-based cooperation, design marketing scene with banking institutions grew Union model, as shown in 5:

Figure 5 Market growth model of banking institutions and Tongcheng Yilong marketing alliance

The "going out" marketing alliance is essentially a process of division of labor and cooperation between the two parties, through customer service and product value to obtain opportunities for sinking market growth, and the ultimate goal is to achieve a win-win alliance and cooperation . Only by deepening the value of the cooperation goals , can the cooperation energy of the marketing alliance be better utilized.

V. Conclusion

Sinking market has a huge potential for economic growth, both for the development of banking institutions , or to operate the same way in terms of eLong , should seize the opportunities and challenges of sinking market development. Through various forms of in-depth cooperation , we will continue to provide customers with high-quality products and services, combined with the country's expansion of domestic demand to drive economic growth , open up new markets together , and finely manage shared customers , so as to achieve a win-win situation for both parties. The goal.

The value of the highly collaborative innovation cooperation between banking institutions and Tong Cheng Yilong can provide a strong innovation driving capability for the economic recovery of the tourism industry, become a model of cross-industry cooperation , and ultimately aim to achieve high-quality economic development in China.