Lee & Associates sums it up: Columbus’ industrial market is red-hot today

Dan Rafter

A torrid pace. That’s what Lee & Associates is predicting for the industrial market in Columbus in its latest research report.

According to Lee & Associates’ second quarter Columbus industrial report, 8.87 million square feet of industrial space is currently under construction in the Columbus, Ohio, market. That’s a big number, and is up from the 6.63 million square feet of industrial space that was under construction in the first quarter of this year.

And Lee & Associates isn’t predicting a slowdown in new construction anytime soon. According to the company, several big industrial projects are ready to start later this summer, bringing what it says is much-needed new product to the Columbus area.

In the Southeast portion of the Columbus market, CT Realty has already delivered its first two spec buildings along Airbase Road, buildings that total more than 1.146 million square feet. Hillwood/NorthPoint completed their two spec industrial buildings at Bixby Road for 872,158 total square feet.

And Core5 delivered its 437,154-square-foot spec industrial building at Southgate Parkway in Licking County.

The numbers for Columbus’ industrial market tell the story of a particularly strong sector that is only gaining momentum. The market saw 2.88 million square feet of net absorption during the second quarter, according to Lee & Associates. And that comes after an even stronger first quarter of the year, when the Columbus market saw 5.02 million square feet of net absorption.

The vacancy rate for industrial product throughout the Columbus market stood at 5.6 percent in the second quarter, up a bit from 4.9 percent in the first quarter of the year. But that increase is mostly thanks to the new industrial product that has been delivered to this market.

The averate listing price for industrial space held steady in the second quarter at $4.41 a square foot.

The area has been no stranger to big deals this year, either. Lee & Associates pointed to Bath & Body Works leasing an entire spec industrial building developed by VanTrust in the Commercial Point industrial park. That building was more than 1 million square feet.

Also, tenants TJX Companies, NFI, Covetrus and Geodis leased more than 100,000 square feet each in Columbus’ Southeast market.

When will those offices fill up? Avison Young’s numbers show Twin Cities office market still struggling even as pandemic recedes

Dan Rafter

Photo by Toa Heftiba on Unsplash

The numbers still show an office market struggling with the impact of COVID-19. But those numbers don’t tell the whole story. According to the latest research from Avison Young, reopening efforts and increasing vaccination rates have the Minneapolis-St. Paul office market ready for the start of a recovery in the second half of the year.

According to Avison Young’s second quarter office report, the unemployment rate in the Minneapolis-St. Paul market has dropped from a high of 11.8 percent to 4.1 percent. That’s a good sign for the office market: As people return to work, companies will eventually begin filling office space again, both in the urban centers of the Twin Cities and across its suburbs.

And while a dipping unemployment rate is good news, so is a rising rate of vaccinations. Avison Young said that vaccination rates across the Minneapolis-St. Paul area continue to outpace total U.S. numbers. So far, 54.5 percent of adults here have received a COVID-19 vaccine.

At the same time, the state of Minnesota recently announced a new recovery budget designed to further stimulate the local economy. The hope is that this combined with the rising vaccination numbers and dropping unemployment figures result in an increase in the number of people returning to their offices and a resulting rise in demand for office space.

The raw numbers in Avison Young’s report show that the office market in the Twin Cities still has a ways to go before it enters recovery mode. Avison Young reported that office leasing activity has largely paused, decreasing by 45 percent when compared with long-term historical averages.

At the same time, the office vacancy rate for the Twin Cities market stood at 10.2 percent at the end of the second quarter of this year. That’s up 190 basis points from the sector’s pre-pandemic vacancy rate of 8.3 percent.

The market’s office sector has also seen negative 1.38 million square feet of net absorption from 2020 through the first quarter of 2021. This amount of negative net absorption has significantly surpassed the lows of the global financial crisis in 2008 and 2009.

Not surprisingly, the amount of office sales has also dipped significantly since the start of the COVID-19 pandemic. As Avison Young says, office sales activity has temporarily paused. The Minneapolis-St. Paul office dollar volume of sales hit $1.3 billion from the start of 2020 to this point of 2021.

That’s a significant drop from usual sales activity, with Avison Young reported that the dollar volume of office sales in the Twin Cities market has decreased by an annualized rate of 29 percent compared with the prior five-year average dollar volume.

Again, these numbers sound ominous. But the good news is that COVID-19 cases continue to fall and a growing number of people are receiving their vaccinations. If that trend holds, there is hope for at least the early stages of an office market recovery in the Twin Cities during the second half of 2021.

Opportunities in the Industrial Real Estate Industry

Industrial Real Estate Watch

Now the industry real estate industry is bustling, various enterprises rush into gold. However, opportunities and challenges often exist side by side. Behind the bustle may be riddled with all sorts of traps.

For example, there is a well-known industrial real estate operators in a city development park project, investment smooth, sold very well, so immediately launched the second phase. However, after the launch of the second phase, no customers, unable to complete the investment. The reason for failure is that a city's enterprise customer base is fixed, the first phase has digested the customer, to the second phase there is no customer. Experienced industrial real estate developers will miss, let alone cross-border developers.

So where are the opportunities in the industrial real estate industry?

Simply put,Industrial real estate opportunities from industrial transformation and upgrading.

Because economic environment, industrial policy and other factors have changed, the industry needs transformation and upgrading. Enterprise production, technology, customers, market changes,Companies will either transform and upgrade or fail. In this context, the demand for carriers and services in enterprises has led to the development of industrial real estate industry.In other words, if the industry does not need transformation and upgrading, there is no industrial real estate.

Industrial transformation and upgrading bring two opportunities: First, industrial transfer; Second, industrial integrationIndustrial transfer is the cross-region migration of enterprises, while industrial integration is the agglomeration of enterprises in regions. Based on this, the customers of the project enterprises in the park can be divided into foreign enterprises and local enterprises.

For private real estate developers, the opportunity lies mainly in industrial integration, that is to say, the investment target is mainly local enterprises.Although foreign enterprises can be imported, it is relatively difficult. Because the enterprise is very cautious in the location, dare not move easily, for fear of staff loss, market loss and other problems. When enterprises choose to migrate across regions, it considers a lot of factors, such as land, preferential policies, subsidies, these are not private industry developers can meet.

Some developers hope that after the completion of the project can introduce a large number of foreign enterprises, which is unrealistic. In fact, to undertake industrial transfer is a matter for the government to attract investment. If private industry real estate to participate in the transfer of industry, must be homeopathic, follow the government's investment policy.

So, more precisely,Opportunities for Private Industry Real Estate Developers from Industrial Integration. Private property developers need to focus on local businesses to find gold from this sector.

The number of local businesses determines whether there are opportunities and how large they can be.In doing industrial positioning, we need to investigate the number of enterprises in the region, roughly distributed in which industrial fields. If there are a large number of SMEs in the region, they have not solved the problem of industrial transformation and upgrading, this is the opportunity.

Industrial real estate must not blindly follow suit, see a park project done well, blind follow-up, this is taboo. After the completion of industrial real estate projects, if the introduction of enterprise customers, will inevitably lead to the project vacant.

Enter the field of industrial real estate, we should be fully prepared,In-depth research on industry and enterprise entry and determine the opportunity to re-enter.

Learning to motivate subordinates correctly is an essential skill for a qualified boss

Burmington Management Consulting Group

Motivation, at any stage of life is a very effective way to promote a positive attitude.

Babbling babies receive encouragement from their mothers to speak bravely;

Children who are new to school will receive encouragement from teachers and play with unfamiliar classmates.

Sons with poor grades will receive incentives from their mothers to work hard to improve their grades.

In the workplace, motivation is a means for the boss to strengthen the motivation of employees to get better results.

However, incentive is also a kind of knowledge, is good is twice the result with half the effort, with bad is to be counter-productive.

So how is it right to motivate employees? Let's look at the following questions first:

There is a horse in the distance. How do you attract it?

A. With grass B. With whip C. With mare D. Walk over and bring

You will find that no matter which method, can achieve the goal. But on closer reflection, each answer has its own problems.

If the horse is not hungry, A may not be effective, and if it is hungry, C. B and D, also if you can get close to the horse, what if you go there and it runs off?

To put it bluntly, how to motivate, or depends on the needs of the motivated. What he wants, what you give, is the best incentive.

In the incentive process, the direct supervisor and the human resources department need to cooperate with each other.

What the immediate supervisor has to do is:

The first is to conduct an employee needs survey, the second is personality needs inspiration, the third is the implementation of spiritual inspiration, and the fourth is to stimulate policy implementation.

What HR does is:

The first is the organization of employee needs survey, the second is the common need to motivate, the third is the implementation of material incentives, the fourth is to stimulate policy.

The main four steps:

Step 1. Investigate employee needs.

Every year, HR department should organize all departments to carry out employee needs survey to understand what employees focus on. Line manager should cooperate with HR department to do employee needs survey, explain the importance of needs survey to employees, ensure the authenticity of employee needs.

Step 2. individual requirements and generic requirements management.

According to the survey results of employee needs, to the common needs, human resources department should establish the company level to meet the needs of countermeasures; On personality needs, and line managers to research specific personality solutions.

The third step, material incentive and spiritual incentive double management.

Human Resources Department is responsible for formulating the implementation plan of material incentives to meet the needs of employees. Line manager to develop specific spiritual incentive programs to meet the spiritual needs of employees.

The fourth step, incentive policy management.

Human Resources regularly complete the incentive policy, supervise all departments to implement in place, line manager is responsible for the implementation of incentives in place. Joint efforts by both sides are really effective incentives.

Why Robots Will Multiply in the Warehouse

The impact of the pandemic on the warehouse industry will have long lasting effects on the industrial sector. From concerns of worker safety to the rush to keep up with the surge in e-commerce orders, the need for increased warehouse automation became evident.

Viewed initially as “early adopter” technologies only affordable to e-commerce giants, robotics are now considered mainstream and are expected to grow in use and popularity. Technology continues to improve and costs have come down making robotics and other automation systems in scope even for smaller and middle market companies.

The Extra Mile

Even before e-commerce’s recent surge, working in a warehouse has long been physically demanding work. In certain warehousing operations, it is not unusual for workers to walk miles per day picking products. Labor productivity is a big focus in warehousing operations which is why “goods-to-person” automation systems make sense.

By 2023, it’s expected demand will quadruple for these systems. One of the reasons: order pickers frequently spend 70-75% of their time traveling. A goods-to-person system can reduce or eliminate that travel, allowing the person to focus 100% of their time on the productive work, and with a properly implemented goods-to-person system, productivity can triple, allowing one person to do the work of three.

The growth of e-commerce has put increased pressure on labor. Today, direct-to-consumer fulfillment operations can require up to 10 times as many employees to individually pick, pack and ship goods. Attracting and retaining qualified workers remains one of the biggest supply chain challenges.

A study last year by Auburn University found that 80% of supply chain professionals considered attracting and retaining labor as a top priority issue. Warehouse wages are increasing, too. For some companies, robotic solutions could offer a better return on investment.

Need for Speed

Millennials are the least patient when it comes to impediments to speed compared to their generational counterparts. Sixty-five percent of them say that long wait times for pick up or delivery negatively impacted their shopping experience, according to a consumer survey by Big Red Rooster, a brand experience company owned by real-estate services firm Jones Lang LaSalle Inc. (JLL).

By 2030, next-day and same-day fulfillment will be the dominant customer requirement, said 80% of the Auburn University survey respondents. The online grocery segment too is scaling to deliver in hours. Online grocery has been one of the fastest growing segments of e-commerce and is anticipated to grow to $100 billion in sales by 2022 according to the Food Industry Association (FMI). Proof of this demand is also reflected as Kroger Co.’s fourth quarter digital sales grew 118%, according to a report by JLL.

Kroger and Britain’s Ocado Group Plc, which opened the first of up to 20 fully automated fulfillment centers in April 2021, will use artificial intelligence, robots with totes and a proprietary control system to pick and pack deliveries. The adoption of robotics and automation systems could help make these consumer expectations a reality.

Reducing Risk

Providing for an employee’s well-being, especially in a fast-paced, competitive distribution environment, is a critical success factor. Workers face a greater risk of injury when they are tired from working long hours, or continually doing repetitive and physically demanding tasks. Not surprisingly, these activities are exactly what robots excel at and desire.

Robotics company Boston Dynamics has created a machine called “Stretch,” which is capable of moving 800 boxes per hour in the warehouse and can potentially be used to unload trucks, strip cases off pallets, and transfer cartons to conveyors. This was driven by the need to manage high-speed operations as well as mitigate the increasing cost of labor.

Eighty percent of supply chain professionals expect greater investments in automation by their companies in the next 10 years, and 88% say they’ll be more reliant on automation and robotics in the nearer future.

New technology and demographics continue to transform the industry, pushing expectations to new levels. From a supply chain perspective, the global pandemic put a huge spotlight on risk management with a special emphasis on people. When it comes to labor, although robotics and automation will never eliminate the need for qualified employees, it certainly can help mitigate the risk.

The Renewal of Old Projects: From Abandoned Steel Mills to Cultural and Tourist Resorts

Core tips:

Through re-design focusing on cultural tourism development, the old industrial plants and mining areas were turned into new city landmarks, cultural tourism leisure and consumer complex, It is not only an important measure to boost consumption, but also fits the development needs of urban leisure blocks. If the factory is the need of the times, then the transformation of the waste plant area is the market needs. However, all the lack of consumer main positioning and precise consumer group, based solely on nostalgia and petty bourgeois sentiment for the artistic transformation are illusory, out of the market, not down to earth, the result is doomed to failure.

In the industrial era, steel mills, mining plants and other industrial bases carry the glory and dreams of a generation. With the development of the times, industrial structure is constantly adjusted, and many industrial bases are gradually abandoned. How do these industrial sites, which witness the urban development, escape the fate of being submerged by the times? Under the blessing of culture and tourism, the industrial heritage is rejuvenated.

In this paper, Bioma summarized the successful cases at home and abroad, through the promotion of cultural tourism and creative architectural design, explore the new life after the transformation of old factory.

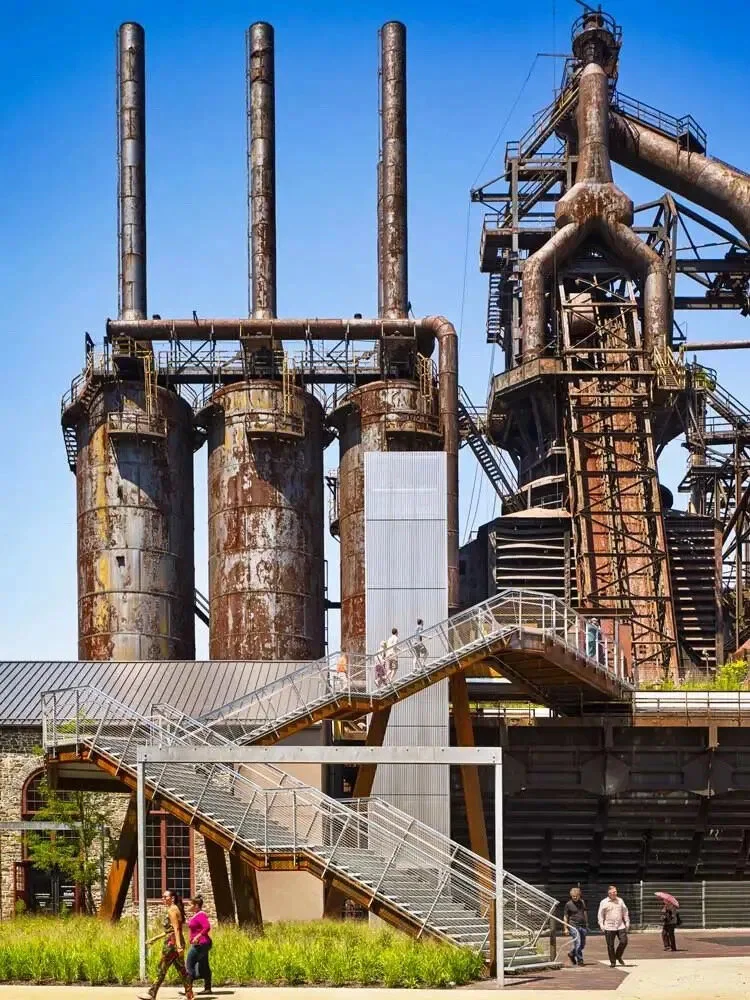

SteelStacks Arts and Culture Park

Steel Stacks is located in northeast Pennsylvania and formerly Bethlehem Steel, Founded in 1857, the 1,800-acre company was once the second-largest steel group in the United States and built 1,127 war ships and the Golden Gate Bridge.

However, the stagnation of infrastructure construction, real estate and automobile and ship industries in the 1980s led to the steel market facing a serious situation of oversupply. The plant was eventually closed, but the story didn't end there. In 2005, Beth Works Now Bass Studio acquired the plant's iconic blast furnace and 126 acres of surrounding land from International Steel Group. The following year with Sands Group Sands to jointly renovate and develop the blast furnace area of Bethlehem Steel.

However, it seems difficult to support the new business by relying on the century-old cultural IP of the abandoned blast furnace area and the Bethlehem steel mill. In order to fully activate the area and bring in more people, the development company offered the government 9.5 acres of land free of charge, and the government lobbied the nonprofit art organization ArtQuest and PBS television stations to settle in.

The final presentation of SteelStacks Art and Culture Park is based on the original industrial heritage, Unified site landscape and new building style, at the same time the addition of overhead corridors, connecting industrial site landscape, Steel Stacks Art Park and the hotel integrated business district, the steel mill and the new community and commercial street to achieve a seamless connection.

The key part of the transformation is to plan a curvilinear path through the campus, while meeting the outdoor open space needs of both sides of the Levitt Pavilion Levett Garden Plaza and ArtQuest Center and the PBS Performing Arts Center, Under the overall plan, the blast furnace site becomes the backdrop for the public space, pushing the Levitt Pavilion Garden Plaza, which incorporates art, entertainment and activities, onto the main axis opposite the main entrance to the park.

Inside the ArtsQuest Center building, music, art and film are almost nonstop - the ArtQuest nonprofit arts organization meets each year inside the Musikfest Cafe, Funding 150 ~ 170 music performances of unlimited style, which brought huge traffic to the hotel business district, as of 2017, On average, over 1000 concerts are held each year, with 13% of the traffic generated by Steel Stacks Cultural Park, Steel Stacks has become a world-renowned art, culture and entertainment park. It has been transformed into Jinsha Hotel on the east side of the park, and has brought in new talents and created a lot of employment opportunities.

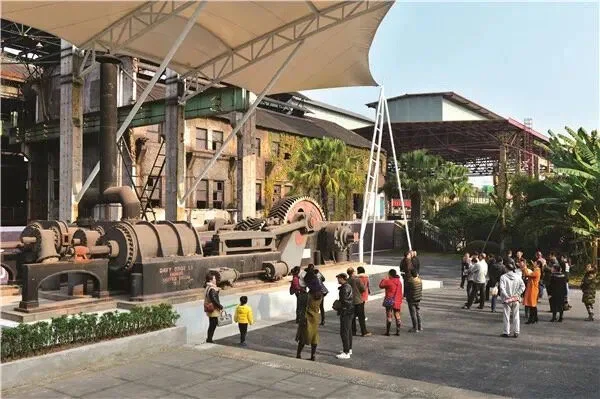

Chongqing Industrial Culture Expo Park

Chongqing Industrial Culture Expo Park is located in Dadukou District, relying on the construction of some industrial remains of the prototype steel plant of Chonggang, Covering an area of 142 mu, with a total scale of 140,000 square meters, it consists of three parts: Industrial Heritage Park, Industry Museum and Cultural and Creative Industries Park. With industrial cultural heritage as the core, it forms an integrated new industrial pattern.

Chongqing Iron and Steel Group is a large iron and steel complex with a history of 100 years. Its predecessor was the Hanyang Iron Works founded by the late Qing Dynasty government in 1890, The steel mill is not only the history of the development of an enterprise, but also the epitome and portrayal of the bumpy progress of China's steel industry. In 2011, due to environmental protection relocation, its steel production system in the old district of Dadukou was all shut down. Then it was transformed into the Chongqing Industrial Culture Expo Park, which integrates "cultural tourism and business" into one, promoting the development of commerce through cultural tourism, so that the area glow with new vitality.

Industrial Heritage Park site in 1905 Sheffield company produced 8000 horsepower two-cylinder horizontal steam prime mover and other valuable industrial equipment exhibits, A number of themed sculptures, installations and statues of industrial pioneers embody the perfect combination of industrial culture and public art.

The Industrial Museum consists of the main exhibition hall, the "Steel Soul" museum and the industrial heritage park. It strives to create a pan-museum with innovative ideas, interactive experiences and thematic scenes.

Cultural and Creative Industrial Park combines the pan-museum and cultural and creative industries organically. It is arranged in the old factory building and the newly built LOFT space in Linjiang to form a cultural and innovation industrial park. Also the industry office, experiential commerce, sports and leisure, boutique hotels, public space leisure exchange areas and other space.

Since its opening in 2019, the park has become a new Internet celebrity punch card, and many visitors are attracted to it.

Whether foreign or domestic, industrial remains are not cold steel and masonry, But the witness of industrial civilization, bearing the culture and spirit of a city, when the wheel of the times rolling forward, these industrial remains should not be abandoned by the city, but need to be through reasonable development and transformation, reactivate these cultural carriers.

One More Chip Company Went Bankrupted

Due to the bottleneck of electronic industry, "chip development tide" started across the country a few years ago. All kinds of funds poured in crazily, and chip industrial parks have also been built in various places.

However, so far, few.chip factories are heard to output chips, some of them have closed down.

Since the collapse of "Huaxintong Semiconductor" in 2019, the most famous one, Wuhan Hongxin, which claims to invest nearly 100 billion yuan, has turned into an unfinished building and invested tens of billion yuan in "Nanjing Dema", with tens of billion yuan spent out, has also declared bankruptcy.

There are also Chengdu Gexin: established in 2017 and stopped working in 2020; Changsha Chuangxin: established in 2013 and auctioned in 2020; Shaanxi Kuntong Semiconductor: established in 2018 and suspended in 2020.

We wonder What on earth happened to these chip companies that once boasted high hope for?

Still, there are some more stories.. A few days ago, there was another piece of news that Shandong chip enterprise, Jinan Quanxin, with 59.8 billion yuan invested in, has stopped paying wages since April this year, and the construction of the factory building has also stopped one after another.

This is a chip enterprise that once had strong support from Jinan, Shandong Province. This enterprise also weny to Taiwan to hire technicians.

According to the report, Quanxin currently has only more than 400 employees, 180 of whom are engineers recruited from Taiwan. The average monthly salary of these Taiwanese engineers is between 50,000 yuan and 100,000 yuan.

The construction of Quanxin's plant began in 2019, when it was planned to build a chip plant that could produce 12 nanometers chips, with an annual output of 480,000 wafers and 2,400 light masks.

The factory has so far ordered a large amount of equipments, and the deposit alone has paid about 1.7 billion yuan.

According to public information, Quanxin was established at the end of January 2019. The three major shareholders are Yixin Jiji Circuit (Zhuhai) Co., Ltd., Jinan High-tech Holding Group Co., Ltd. and Jinan Industrial Development and Investment Group Co., Ltd. The last two units are all affiliated to Jinan State-owned Assets Supervision and Administration Commission.

However, the business is now facing great difficulties.

An employee of Quanxin said in an interview with the reporter, "The company is in a very difficult situation now. Since April, it has stopped paying salaries, and the company is forcing employees to leave."

The contractor in charge of plant construction also said, "This enterprise has changed the general contractor many times during the construction of