How Will RFID Change Retail in 2021?

BY RFID JOURNAL

Throughout its rich history, radio frequency identification (RFID) technology has been ever-evolving. Recent pressure on supply chains has made many retailers revisit the idea of implementing an RFID solution. They're leaning into the technology to help improve operations and reduce the burden on staff. During the last 20 years, RFID technology has matured to the point that it can help most organizations optimize their business models.

RFID in retail environments saw early adoption, with Walmart implementing the technology for item-level identification years ago (the company has since halted such efforts). Since then, other retailers have embraced RFID as irreplaceable for supply chain tracking, stock management, inventory control and retail sales management. Advances in supporting technologies like the Internet of Things (IoT), big data, and artificial intelligence are giving RFID new life and helping to redefine what's possible in the retail space.

Even before the COVID-19 pandemic, the global RFID market was set to grow by more than 10% CAGR during the next five years. Analysts revised their projections last year, but the RFID industry is still expected to see an average growth of more than 6% annually until 2025.

Latest RFID in Retail Trends for 2021

RFID and its associated technologies, such as Near Field Communication (NFC) and Bluetooth Low Energy (BLE), are reshaping the retail landscape across the entire lifecycle. With logistics, distribution, stock placement and fulfillment already finding ways to improve processes using RFID, the increased adoption continues to lead to innovations.

Current statistics support this assertion. According to GS1, 47% of the items received by retailers carry RFID tags and 57% of retailers are now implementing the technology. With the additional insights into every element of retail operations, brick-and-mortar shops are looking to level the playing field against online competitors and are using RFID to enable their own ecommerce presence.

Although each business case varies, the latest trends continue to improve on existing efficiencies with reduced costs, easier integration and hybrid implementations. Here are some of the latest trends for RFID in retail that will shape 2021.

Introducing RFIQ for Retailers

Marshall Kay introduced a new concept for retailers in a recent Forbes article. RFIQ, according to Kay, allows companies to learn their RFID intelligence and understand where there are opportunities to improve. Although Kay readily admits he does not yet have a standardized test, some questions can help retailers uncover additional value from their RFID operations. Questions include: What is RFID and how does it benefit consumers? Which companies use RFID, and how does it help them? Why do competitors view RFID as essential, and where do they apply it?

The idea is that some organizations matured with the technology and today are benefiting from a higher intelligence in its use and application. For anyone looking to catch up, the learning curve may be steep but not insurmountable. Moreover, newcomers to RFID will have the benefit of learning from those that already paved the way and are utilizing the technologies it spawned.

RFID Is Bridging the Online and Physical Gaps in Retail

The RAIN RFID Alliance promotes the use and standardization of ultrahigh-frequency (UHF) RFID solutions. RFID doesn't just push for adoption and standardization—it also focuses on finding new and innovative applications for the technology. One way to achieve this is to educate retailers about how large-scale adoption may be cost-prohibitive and complex.

Instead, the Alliance advises that companies focus on elements like targeted accuracy, real-time visibility, omnichannel capabilities and securing inventory. With RFID, retailers can automate their inventory data and improve accuracy by 30%, while reducing out-of-stock situations by 50%. By streamlining the entire lifecycle of operations one step at a time, retailers can maximize their ROI and ensure a smooth RFID rollout throughout their organization.

Combining Item-Level RFID with 2D Barcodes

Many retailers remain locked into their legacy systems. Everything from their financial to material management systems took years to integrate with 2D barcode solutions. What last year showed us is that these technologies remain entrenched in the retail sector. Even if their inventory management did take more time, swapping out one system for another simply isn't feasible.

The answer to this question now seems to be to adopt the newer GS1 standards for both technologies, allowing companies to combine and integrate new RFID systems with legacy applications. For organizations that require stock accuracy, a local RFID system that integrates with national inventory can help increase efficiencies drastically. In some pilot projects, companies were able to cut costs in half by implementing RFID with their 2D barcode systems.

RFID and Big-Data Analytics

Big-data analytics is now a mature and intelligent technology that helps to improve business operations. The benefit of having a relationship between RFID and big data is easy to understand: better data equals better analytics. By gaining an overview of all operations, from source to fulfillment center, analysts can use this information to streamline routes, optimize inventory and predict demand for specific products.

The better connected the physical retail world becomes to the digital systems that manage them, the more efficiently a retailer can operate. The rapid development of information and communication technology, as well as improvements in RFID scanning and transmitting systems, means any organization can implement a solution that will help it increase efficiencies quickly.

AIM Global Updates RFID Testing Standard for Medical Devices

BY CLAIRE SWEDBERG

The latest version of the 7351731 standard offers updated guidance to help medical device manufacturers and users test their products with UHF, HF and LF RFID readers, to ensure immunity to RF transmission effects.

Industry standards group AIM Global has released the latest version of its standard for the testing of non-implantable wireless medical devices, to help users and manufacturers better determine if they are immune to emission from RFID technology. AIM's 7351731 standard provides companies with guidance to test medical devices and determine whether RFID transmissions pose any risk to their operability. The standard offers test protocols for 125 kHz LF and 13.56 MHz HF RFID compliant with ISO 15693, as well as UHF RFID transmissions and both active and passive technologies.

AIM is a global industry association that offers networking, education and advocacy to promote and standardize automatic-identification technologies. It covers RFID, barcoding and smart devices used in Internet of Things (IoT), real-time location system (RTLS) and blockchain applications. The organization's latest healthcare standard revision, which it announced in June of this year, provides updates to the previous version of the standard, which was developed by AIM's healthcare initiative workgroup, within the RFID Experts Group (REG HCI), according to Mary Lou Bosco, the COO of AIM and AIM North America.

Mary Lou Bosco

RFID is frequently used in healthcare environments for asset and inventory management, as well as for patient and personnel tracking. For instance, RFID tags can be applied to high-value equipment, laptops, carts and medications, as well as to packaging for surgical implants and tools. RFID-enabled wristbands and badges can be worn by hospital personnel, in addition to both adult and infant patients.

Test labs have been testing against the standard for several years, Bosco reports, and some have provided suggestions for improving the testing protocols to the AIM working group. This third version of the standard is intended to reflect the latest testing needs, and to be easier to implement than previous iterations. The update is part of regular review and revisions that AIM provides for all of its standards, "AIM periodically reviews these documents," Bosco states, "to make sure all the information is up to date and conforms with the most recent technology advancements."

Several ISO/IEC documents have been revised since the release of the initial standard, and AIM thus updated its standard to accommodate those changes. The working group adjusted the standard according to requests from RFID solution designers, Bosco says, as well as from medical facility engineers and administrators. All of the previous groups have performed the test methods and test levels for evaluating the electromagnetic immunity of non-implantable medical electrical equipment and systems to electromagnetic emissions from RFID readers. AIM has been working with these parties, she says, "to give as clear guidelines as possible with how to perform the testing."

The changes, which include clarification of some figures to make them easier to interpret, take into account updates to several ISO/IEC documents, as well as comments from the labs that performed the testing in the standard. "The specially appointed workgroup thought that enough new information was available to update the standard," Bosco says, "and make testing methodologies clearer for those reading and implementing the standard."

The standard guides medical device manufactures and end users on how to evaluate their devices' immunity to emissions as RFID readers interrogate tags within the vicinity. The test procedures are based on experimental results from several AIM members and testing labs that performed the standard's test methods, Bosco says. Working together, these parties reached an agreement on how testing should be performed and the verbiage that should be used to specify the standard's testing requirements.

Test protocols are included for the major commercial implementations of RFID. The standard is designed for testing existing medical electrical equipment and systems. For the purposes of this standard, Bosco notes, other technologies, such as Wi-Fi and ultra-wideband, are not considered. Instead, she says, LF, HF and UHF represent the most common RFID technologies currently deployed in healthcare environments.

While there is no official certification process for devices that pass testing, AIM has encouraged those that have carried out testing to contact the association with their results so that it may continue to collect a list of those who claim they can perform the test. The standard guidelines can also offer guidance for RFID solution designers, to help them determine during the designing stage whether medical electrical equipment and an RFID solution environment are compatible. Immunity to RFID reader testing is required by the FDA for medical devices.

According to the FDA, the use of RF wireless technology offers advances in healthcare, but because airways are shared, the function of a wireless medical device could be affected by the presence of other wireless devices within the vicinity. One example might be losing data or experiencing disruption in operation. The FDA advises healthcare facilities to consider the selection of wireless technology, quality of service, coexistence and security when choosing RFID and other wireless technologies.

Can private controlled high-speed rail stir "a pool of spring water"?

Gu Yang Economic Daily

Recently, two pieces of news about high-speed rail have attracted much attention. First, the Beijing-Shanghai high-speed railway, which operates at the fastest speed in the world, has ushered in its 10th anniversary; Second, Hangzhou-Shaow-Taiwan Railway has achieved full track laying and running, and will become China's first private controlled high-speed rail line after its official operation by the end of the year.

This is the business room on the Fuxing smart EMU G6 train taken on June 25. Photo by Wang Xiang (Xinhua)

As one of the world's busiest rail lines, the Beijing-Shanghai high-speed rail is far ahead in profitability. Public information shows that between 2014 and 2019, The net profit of Beijing-Shanghai high-speed railway increased by 39.4% annually. Even under the severe impact of Xinguan pneumonia epidemic in 2020, it still achieved a profit of 4586 million yuan, which is a veritable benchmark for high-speed railway profitability.

Such a high return, I am afraid there is no social capital not tempted. But for a long time, social capital has mostly played a supporting role in railway construction, especially in such an important infrastructure field of people's livelihood as high-speed rail. It was unimaginable for social capital to achieve absolute control. Now, the Hangzhou-Shaow-Taiwan high-speed railway is the first to "eat crabs," taking the lead in realizing the absolute control of social capital.Although its market prospects are uncertain in the short term, it will be a far-reaching icebreaker for the reform of the national railway investment and financing system。

In recent years, social parties to open and encourage social capital to participate in major infrastructure construction calls are increasing. For the need of economic development, some localities have made some useful exploration to attract social capital to participate in the construction of infrastructure projects and made some progress. But overall,Social capital in participating in the construction of projects is still lack of a clear grasp, asymmetric information, high financing costs and other factors, so that many social capital deterred。

Because of this, the "pool of spring water" stirred by the Hangzhou-Shao-Taiwan high-speed railway brings confidence to the social capital in the wait-and-see hesitation. This confidence comes not only from innovation in equity structure,More from the social capital to obtain a more adequate operating rights, income rights for good expectations。

It is understood that Hangzhou-Shaow-Taiwan high-speed rail holdings from the beginning to establish a "railway + PPP + industry" operation model, clearly proposedThrough property, shops, advertising space and more flexible exploration of commercialisation, replacing the traditional model of relying solely on ticket revenue. For example, the development reform, the State Railway Group and other departments have made it clear that they will support enterprises to determine their own fares, determine the number of trains, and give them the right to make decisions freely. In addition, social capital will benefit from the potential benefits of upgrading urban efficiency, industrial agglomeration and expanding employment brought by high-speed rail.

April 17, construction workers in the last section of the Jiaojiang Super Bridge of Hangzhou-Shao-Taiwan Railway hoisting construction. Photo by Huang Zongzhi (Xinhua)

It should be said that these policy initiatives demonstrate the government's determination and sincerity to attract social capital to participate in infrastructure construction, and also fully demonstrate the rational attitude of all parties to the project to respect the law of economic operation and follow the principle of marketization. As market analysis points out, under the new model,More emphasis on the rate of return on investment social capital is expected to be more focused on the people's livelihood security functions between the formation of a more benign and efficient interaction between the state-owned capital, which will help further the key role of investment.

At present, China's economy is continuing to recover. It is expected that consumption and investment demand will slowly recover in the second half of the year, which will give a stronger impetus to economic recovery.In this context, to further enhance the growth stamina of private investment, we must continuously stimulate the vitality of various social capitalOn the one hand, we should open up the market access of private enterprises, support their innovation and development, encourage private capital to participate in the construction of "two new and one heavy" projects and complement the weaknesses; On the other hand, we should strengthen the investment capacity of social capital, innovate investment methods, promote the implementation of cost-cutting policies for private enterprises, and make good use of bank credit, market bonds and other financial instruments.

Of course, to fully mobilize market subjects and social forces to participate in infrastructure construction, we should also make overall plans to strengthen the foundation, increase functions, benefit the long-term, benefit people's health, and prevent risks.In this process, we should fully stimulate the endogenous driving role of innovation. At present, in addition to the Hangzhou-Shaow-Taiwan high-speed railway taking the lead in the investment and financing system, The pilot of real estate investment trusts (REITs) in the infrastructure sector is also steadily underway, and we can expect more such innovations in the future to expand the scope for social capital to participate deeply in infrastructure construction.

Global Emerging Technologies Summit in Washington, DC

U.S. Embassy in China

The National Security Council on Artificial Intelligence (NSCAI) hosted the Global Emerging Technologies Summit on July 13, 2021 in Washington, DC.

Secretary Blinken said at the summit: “We need America and its partners to continue to be the world's innovation leaders and standard-setters, Ensure that all future innovations remain centred on universal rights and democratic values and that they bring tangible benefits to people's lives.”

Read the full text of the Secretary of State's speech by clicking "Read More" or by following the link below:

https://www.state.gov/secretary-antony-j-blinken-at-the-national-security-commission-on-artificial-intelligences-nscai-global-emerging-technology-summit/

Tourism season is approaching, cultural tourism real estate drainage strategy

Industrial real estate think tank

Summer is coming, many enterprises and institutions to give their employees travel travel benefits, at this time, all kinds of schools began to have holidays, some self-driving tours, outdoor travel and other industries of the crowd, in this time planning travel destinations and routes. These people from different industries form the annual traveling army. These huge traveling army will soon go to the famous cultural tourist attractions around the country. The climax of the traveling is coming. The huge tourism crowd provides the consumption foundation for the cultural tourism business and contributes to the huge consumption. In this period of tourism peak season, a lot of drainage effect stronger cultural tourism attractions and its supporting businesses, the use of services consumers can contribute to the year's major performance.

Culture and Tourism Market Size

In 2019, prior to the epidemic, data showed that 60.6 million domestic tourists visited, up 8.4 percent from a year earlier. In 2020, the number of domestic tourist arrivals was 287.9 million, down 30.2 million or 52.1% from the same period last year. With the continued stability of the epidemic situation, the increase of the number of vaccinated, the formation of mass immunization, tourism travel warming development has been the general trend. For cultural tourism business, the beginning of tourism peak, means the start of "robbing people war," In the face of this irreplaceable online experience travel consumption, and tourists are most willing to spend, cultural and tourism businesses are gearing up and ready to go.

Integration of business travel and culture

Domestic Tourist Arrivals and Growth Rate from 2015 to 2019

As for drainage, cultural tourism business has an advantage over the commercial sites represented by pure shopping centers. Cultural tourism businesses mostly have cultural tourist attractions that can be relied on to drain water, and then through commercial services to turn the attracted traffic into performance. There is a huge tourism consumer, the corresponding will also have a huge cultural tourism business, there is no competition between consumers, business will be competitive, In the final analysis, the main competitors of cultural tourism business come from cultural tourism counterparts, the success of drainage depends on the characteristics of attractions, popularity and supporting business services, the purpose of drainage is business tourism cultural integration development, one-stop to meet the needs of cultural and tourism consumers.

In competition, the traditional saying is that people have no self, people have my excellent, Bioma China Commercial Real Estate Consultants believe that, Cultural tourism business in the drainage, as attractions can not change what, but can change the business, can change format combination, commercial content, commercial operation to make a person without me, people have me excellent reasonable change, to achieve drainage.

Travel Commercial Drainage Advice

1. Precise FitManagement's market positioning.

Cultural tourism business, although with an obvious cultural tourism attribute, but still needs a correct and reasonable market positioning in line with cultural tourism consumer. Among the traveling army, the main force at present is the new generation group represented by the post-90s. There are many differences between post-90s and the previous generation in their tourism focus, tourism consumption, consumption hobby and consumption intention. In the positioning, we should take into account the unique, diversified and trend-oriented consumption characteristics of the post-90s and Z generation young groups, and give a scientific and reasonable positioning. In addition, the needs of cultural and tourism consumers are diverse, such as experiencing exotic food and beverage features, experiencing exotic leisure and health features, buying exotic souvenirs, local products, medical and health supplies, going to summer, Some cultural tourism business positioning is the whole format, some positioning focus on leisure experience, and some positioning emphasis on retail light luxury, For cultural and tourism business, suitable for their own positioning is successful, positioning success, cultural tourism business will have a successful basis for protection.

2. Featured business portfolio strategies.

After determining the positioning, the business will have a basic frameworkwork, backbone, around the backbone of investment placement, placement in line with consumer demand business forms interconnected combination, forming a popular linkage, A link link complementary to meet the needs of consumers one-stop, on the one hand to save consumers' time, and on the other hand to improve consumers' random consumption, consumers also like one-stop shopping needs to meet, rather than take the demand apart north and south everywhere.

3. Characteristic creation of merchandise.

The characteristic product is the key of drainage, can arouse the consumer's desire to buy, this is not only cultural travel business, any business can apply. The featured products are mainly as follows: delicious food and beverage, special local products with health care function, special massage, acupuncture and bone-setting health service, Characteristic regional attribute food, yak meat, homemade yogurt, black wolfberry, Tianshan snow lotus and other tangible and intangible goods, give consumers the most direct experience of the feeling, produce consumer desire. Color, smell and taste of the characteristic snacks, can instantly ignite consumers desire to taste, since the media era word of mouth to realize drainage.

4. Cover all kinds of publicity online and offline.

The popularity of cultural tourism directly affects the popularity, the more well-known cultural tourism business flow will be greater, In the tourism season on the eve of the promotion of visibility is essential, today's fierce competition is also afraid of the alley deep, propaganda films, endorsements, shaking sound, little red book, B station and other online advertising.

5. Internet celebrity, well-known travel blogger, game anchor cooperation.

Invite traffic internet celebrity, well-known travel blogger, to the project experience, personally visit the project more representative shops, And can record video, live broadcast, take pictures and so on, show to a large number of consumers to watch comments, cause Walter heat, in the consumer psychological impression, attract consumers to experience, wake up consumers desire to experience.

6. Fusion innovation.

Innovation is still the magic weapon of cultural tourism business, doing business with heart, exploring innovation is the most effective core play of cultural travel business. One-stop to meet the needs of consumers business travel culture, providing innovative service initiatives, spiritual material dual meet consumers.

Epilogue

In essence, cultural tourism business is still centered around cultural tourism consumers, creating a spiritual satisfaction, social attributes of the lifestyle. Characteristic social attributes are still the core of drainage, Bioma China Commercial Real Estate Consultants believes that with the rise of a new generation of Chinese cultural travel consumers represented by Generation Z, The format structure and positioning of cultural tourism business should also take into account the needs of the new generation of consumers. More and more research shows that Emerging cultural travel consumers expect travel destinations to be cultural, comfortable, social and unique, cultural travel business should pay attention to these, in order to attract the younger generation of consumers, to determine the basis for success.

Who is suitable to do business investment park work?

Industrial Real Estate Watch

Among all positions in the field of industrial real estate, the requirements of investment officers are the most extensive. As long as the project can bring customers, everyone can do investment personnel.

Although there are no restrictions on investment work, but investment work pressure, performance is not good, and not the average person can be competent for this job. Then, who is suitable to do the work of investment park?

One, well-connected, have certain connections

Networking is very important to the investment work, including expansion, negotiations, project landing and other links play a key role. Some people will find that their efforts to do business for a few months, not as fast as colleagues rely on contacts to bring customers.

Some park projects in the recruitment of investment personnel, will understand the candidate's family background and social relations, priority to admit a certain relationship.

If you have a background of contacts, working in the park investment is a good choice.

II. Having been in charge of an enterprise and having entrepreneurial experience

It is a complex process to do business investment in the park, and it is the process of serving enterprises, which requires business investment personnel to understand enterprises and industries.

A person who has been in charge of an enterprise or has entrepreneurial experience, has a deep understanding of the enterprise, knows how to locate an enterprise, and can provide professional consulting services for enterprise customers.

Therefore, this kind of people do business investment easy to seize the pain point of enterprises.

Zhongye Huigu · Huai'an Science and Technology Industry Park

III. Strong learning ability and adaptability

If you do not have two advantages in front of the investment personnel only through continuous learning enrichment, so that their faster growth. In the process of investment promotion work, accumulate contacts and project follow-up experience.

For most people, engaging in investment work is starting from scratch, No experience, no contacts, no resources, rely on the investment in the front line of work, increase their knowledge reserves, accumulate investment experience, improve market acuity.

Therefore, the talents with strong learning ability can persist in the job of investment promotion.

How the I-55 Corridor is shaping the new e-commerce supply chain

Ajlatrace

Rooftops. Population. Talent. These are just a few of the buzzwords you’ll hear developers and brokers mention when they talk about the I-55 corridor. And there’s a good reason for it.

Running from downtown Chicago southwest out towards Bolingbrook and then further south to Bloomington/Normal, Springfield and beyond, I-55 provides a combination of easy access to Chicago population density, the sprawling industrial rooftops of Will County, and everything in between. And you’ve also got Midway airport, the Bedford Park Rail Yard and the CenterPoint Intermodal Center all within reach.

It’s no wonder why I-55 has really become known as being one of the region’s main logistics and distribution corridors. Developers are building spec facilities at a feverish pace and yet tenants continue to line up to occupy these new Class A spaces along the route.

“In Chicago, the focus tends to be on O’Hare, and O’Hare is ground zero for where institutions want to place money and where people want to be,” says Nick Siegel, Chicago Region Partner with Bridge Development. “But I-55 has a lot of the same dynamics as O’Hare: a good, modern highway system, access to labor, access to the city of Chicago, and access to rooftops.”

“Frankly, [the I-55 corridor] is our most modern distribution submarket that can reach Chicagoland quickly,” Siegel adds. “It checks all the boxes of somewhere that you want to locate.”

And indeed, the I-55 corridor is witnessing somewhat of a “Field of Dreams” effect, if you will. If you build it, they will come. And they just keep coming.

Some of the companies with a big distribution and logistics presence along the corridor include RJW Logistics, Best Buy, Crate & Barrel, and of course, there was also Amazon’s $50 million purchase of the 119-acre former Old Chicago amusement park in Bolingbrook which the e-commerce giant plans to use as yet another major distribution center for the metro area.

And then there’s the upcoming Wayfair fulfillment center in Romeoville being developed by Duke Realty. The online furniture retailer will bolster its Chicago distribution via a 1.2 million square-foot facility spanning over an 81-acre site.

“I-55 is a very important piece of our strategy for Chicago,” says Susan Bergdoll, midwest regional leader and SVP of Leasing and Development for Duke Realty. “I have four projects under construction right now and three of them are in the I-55 submarket, so that’s how bullish we are on that market.”

Because it’s a mature, built-up submarket, there are additional layers of complexity when planning new developments. For instance, Duke has already completed at least one redevelopment along I-55 where the existing structure was demolished and a new one built in its place. And for deals like the Wayfair facility, it required patience and timing to piece together multiple properties in order to create the one large industrial site.

The nature of I-55’s reputation as a distribution and logistics corridor, combined with the increase in e-commerce shopping and even the supply chain disruptions for raw building materials equates to scarcity of industrial product in the corridor, meaning that landlords are finding themselves in an even more ideal situation in terms of leverage and negotiating power.

“Rents are going up as we speak. Typically, people were used to a 2-3% increase per year, but if you’re coming up on your lease now, you could be getting a 20-30% increase,” says Jeffrey Kapcheck, Executive Vice President with CBRE. “I’m in the process of representing different tenants with lease renewals and new leases, but the renewal part is the most glaring aspect of it because of the large increases that landlords are asking for, and getting for the most part.”

Until supply catches up with demand, the industrial landscape throughout the I-55 corridor will remain a landlord’s market. But the continued strain on the supply chain for building materials isn’t helping.

“We’re up to 92 million square feet [of industrial space] and the vacancy rate is down to 7%, so I think developers and landlords realize that with the scarcity of land, they’re taking advantage of the lack of product on the market,” Kapcheck adds. “And I mean, COVID didn’t help because construction is down 40% from last year.”

At the end of the day, it’s the shifting buying habits of consumers and the need for labor that is helping drive the industrial e-commerce boom in the Chicago area.

“It’s not that we’re buying more products, it’s that we want them quicker,” Kapcheck says. “I think everyone right now is reimagining and reinventing their supply chain. It’s usually a three-step process where you’ve got the larger building, the mid-sized building, and the smaller urban logistics or last mile building.”

Kapcheck elaborates, suggesting that the larger distribution centers, which can range from 1 million to 2 million square feet might be located out along the I-80 or I-57 corridors, while the mid-sized facilities that span 500,000 to one million square feet are more likely to be found along I-55. Then there’s also the smaller last-mile hubs of 100,000 to 500,000 square feet which will be the closest to the population center.

While there’s been a lot of emphasis put on and attention paid to e-commerce, there’s much more to the Chicago area’s industrial market when you zoom out of the I-55 corridor, Bridge’s Nick Siegel suggests. And in many ways, having a healthy blend is good for landlords, tenants, and the municipalities that rely on the good jobs and taxes that industrial facilities provide.

“If you step out of I-55 and look at the market in general, Amazon is leasing a lot of space, but they’re also not,” Siegel says. “The leases in our portfolio that we’ve done on our spec buildings are with large manufacturing companies. We’ve done two separate manufacturing consolidations; one in Wood Dale and one in Itasca.”

And the blank slate spec building is designed to be flexible for a reason, Siegel adds. We can’t predict how markets will evolve and which industries will be hot, but if you build a space that meets the demands of many different types of businesses, you’re going to be safer in the long run.

It’s trying to get the right mix of users, which not only further promotes economic development, but provides stability and insulation from any future economic downturns. After all, real estate is a cyclical market, and there’s always a need for some level of caution when looking at the big picture risk. But Chicago’s geography, infrastructure, talent and sheer size also help provide further insulation from fluctuating economic conditions.

“One thing that I think gets lost in the mix is that we’re the second largest industrial market in the country,” Siegel says. “So this is just a massive, massive market with so many factors at play and I think we’re insulated from a lot of that risk because we’re not so dependent on one user type. We’re a really diversified, mature market and I think that benefits us tremendously when it comes to leasing velocity and keeping supply and demand in check.”

Industrial on pace for record-setting sales? It could happen in 2021

Dan Rafter

While the COVID-19 pandemic has devastated commercial real estate sectors such as retail, office and hospitality, it has provided a boost to industrial, a segment of the industry that was already thriving before the pandemic hit.

And today as the pandemic continues to recede in the United States? The industrial market continues to boom.

That’s the takeaway from the June National Industrial Report released by CommercialEdge. According to the report, lease rates for industrial space across the country averaged $6.59 a square foot in May. That’s an increase of 4.4 percent when compared to the same month in 2020.

Not all cities are seeing the same amount of rent growth, though, with CommercialEdge reporting that the highest rent growth continued to be seen in coastal cities, with the Southern California markets of Inland Empire and Los Angeles ranking first and second in year-over-year rent growth.

The national industrial vacancy rate hit 5.7 percent in May. And in the Midwest, the Nashville, Tennessee, industrial market’s vacancy rate fell to 3.1 percent in May.

Another impressive number? As of May 31, $18.1 billion in transactions closed across the U.S. industrial markets that CommercialEdge tracks. The average sales price per square foot for industrial space was $103 in May. That’s 16.3 percent higher than in May of 2020.

CommercialEdge doesn’t expect the good times to end throughout the rest of this year, either. The company said that U.S. industrial sales could match or even beat the record $44.4 billion in transactions closed in 2020.

The numbers also show that sale-leaseback transactions have become increasingly popular in this sector. Such deals accounted for 7 percent of the total U.S. industrial sales closed last year and 9 percent of property trades made since the start of this year. Among the industrial transactions closed during the previous 17 months across the markets tracked by CommercialEdge, sale-leaseback deals amounted to $4.8 billion.

These deals have been valuable. CommercialEdge says that since the beginning of 2020, the price of a sale-leaseback deal has averaged $116 a square foot, significantly higher than the overall average of $93 a square foot of industrial space sold during that same time.

CommercialEdge found three markets that have already exceeded $1 billion in industrial deals closed since the start of 2021. That includes Chicago, which has seen $1.1 billion in industrial sales since the beginning of the year, behind only Los Angeles and Inland Empire.

CommercialEdge found, too, that there is plenty of industrial space now under construction. In May, 410 million square feet of industrial space was being built in the U.S. markets the company covers.

And Chicago ranks high here, with 20 million square feet of industrial space under construction at the close of May. This figure is behind only the 28 million square feet set to come online in the Dallas-Forth Worth metropolitan area.

Chicago’s white hot industrial market means all hands on deck for property managers

Ajlatrace

As commercial real estate’s wild ride continues well into the warmer summer months, industrial landlords and investors have found themselves in one of the best imaginable situations compared to other asset classes. With high demand for and investor interest in industrial space, it truly is a landlord’s market in 2021.

However, this doesn’t mean that industrial property management is a set it and forget it proposition. If anything, the white hot demand for industrial means that landlords have to be more involved than ever in their lease deals.

“I think in today’s environment, [industrial property management] has really shifted to being much more hands-on,” says Victoria Knudson, Partner & National Leader of Property Management for Stream Realty. “Tenants want to understand their lease, what is their responsibility versus your responsibility — there is a lot of a lot more communication as it relates to how things run and managing expenses.”

And not only has tenant management become more hands on, the number of phone calls with other layers and players in the industrial segment have also increased dramatically, Knudson adds

From inquiries about available space, discussions about the local workforce, and talks about budgets, industrial landlords have also had to become comfortable with wearing multiple hats and expand their breadth of knowledge when it comes to the many different aspects involved in a site selection process or deal negotiations.

But the biggest issues for industrial tenants, particularly in logistics, warehousing and light manufacturing, remain costs associated with fuel and access to labor, Knudson says. Real estate is more or less a fixed expense, but it’s finding that balance of tapping into the right workforce and also being located where it makes the most sense for fuel and transportation costs.

With there being so much demand for industrial space, industrial landlords haven’t had to have the painful conversations about concessions and deferral arrangements that office and retail property owners and managers have been faced with throughout the pandemic. Instead, it’s almost been the opposite, Knudson suggests.

“Our [industrial] occupancies across the country are in the mid-90s percentage wise, and I run our national platform for industrial property management,” Knudson says. “Industrial is the hottest commodity and it can’t be built fast enough to be filled … so there’s no concessions and no rent credits. Our accounts receivable does not exist; it’s zero.”

Leasing has also been very strong for Duke Realty, which is currently building a handful of new industrial developments across the Chicago area at the moment. Susan Bergdoll, Senior Vice President Leasing and Development for Duke Realty, is leading the charge in the Chicago area and greater midwest for the REIT.

“Our [Chicago area] portfolio is 17.2 million square feet and I have two vacant spaces right now,” Bergdoll says of the strong demand and limited availability for Class A industrial space in the Chicago region. And tenants paying top dollar will expect all the bells and whistles, such as efficient overhead LED lighting, modern HVAC systems, and plenty of trailer parking.

But there’s still much more on the way. Currently, Duke is working on four new industrial developments in the Chicago area, including two spec projects: a 300,000-square-foot development in Bellwood and a 370,000-square-foot facility in Woodridge. Both of these new facilities are anticipated to be completed by the new year.

And similar to other major property owners and managers, Bergdoll says that her team has not had to offer free rent or other concessions to tenants. “The industrial market is so strong right now that we aren’t faced with some of those painful conversations that office and retail landlords are faced with,” Bergdoll adds.

However, if it means keeping a tenant and a lease renewal, all options are on the table, Bergdoll suggests. In this intensely hot and competitive market, it’s truly survival of the fittest.

“You’ve got to know who you’re competing against,” Bergdoll says. “You could be competing against a building that’s been sitting vacant for 12 months and that guy might be a lot more willing to offer up some concessions.”

One of the biggest unknowns facing industrial real estate right now is just how long the hot market will go on for. Both Bergdoll and Knudson aren’t too worried, at least for the meantime. Nevertheless, the near future looks just as bright for industrial landlords and property managers.

“We’ve been on an upward trend with industrial for a long time coming and it just continues to grow and grow,” says Knudson. “I don’t have a crystal ball so I don’t know that it can sustain forever, so at some point things will give, but for the foreseeable future — I’d say the next 24 to 36 months — I don’t see a decline; the demand is just too great.”

Lee & Associates sums it up: Columbus’ industrial market is red-hot today

Dan Rafter

A torrid pace. That’s what Lee & Associates is predicting for the industrial market in Columbus in its latest research report.

According to Lee & Associates’ second quarter Columbus industrial report, 8.87 million square feet of industrial space is currently under construction in the Columbus, Ohio, market. That’s a big number, and is up from the 6.63 million square feet of industrial space that was under construction in the first quarter of this year.

And Lee & Associates isn’t predicting a slowdown in new construction anytime soon. According to the company, several big industrial projects are ready to start later this summer, bringing what it says is much-needed new product to the Columbus area.

In the Southeast portion of the Columbus market, CT Realty has already delivered its first two spec buildings along Airbase Road, buildings that total more than 1.146 million square feet. Hillwood/NorthPoint completed their two spec industrial buildings at Bixby Road for 872,158 total square feet.

And Core5 delivered its 437,154-square-foot spec industrial building at Southgate Parkway in Licking County.

The numbers for Columbus’ industrial market tell the story of a particularly strong sector that is only gaining momentum. The market saw 2.88 million square feet of net absorption during the second quarter, according to Lee & Associates. And that comes after an even stronger first quarter of the year, when the Columbus market saw 5.02 million square feet of net absorption.

The vacancy rate for industrial product throughout the Columbus market stood at 5.6 percent in the second quarter, up a bit from 4.9 percent in the first quarter of the year. But that increase is mostly thanks to the new industrial product that has been delivered to this market.

The averate listing price for industrial space held steady in the second quarter at $4.41 a square foot.

The area has been no stranger to big deals this year, either. Lee & Associates pointed to Bath & Body Works leasing an entire spec industrial building developed by VanTrust in the Commercial Point industrial park. That building was more than 1 million square feet.

Also, tenants TJX Companies, NFI, Covetrus and Geodis leased more than 100,000 square feet each in Columbus’ Southeast market.

When will those offices fill up? Avison Young’s numbers show Twin Cities office market still struggling even as pandemic recedes

Dan Rafter

Photo by Toa Heftiba on Unsplash

The numbers still show an office market struggling with the impact of COVID-19. But those numbers don’t tell the whole story. According to the latest research from Avison Young, reopening efforts and increasing vaccination rates have the Minneapolis-St. Paul office market ready for the start of a recovery in the second half of the year.

According to Avison Young’s second quarter office report, the unemployment rate in the Minneapolis-St. Paul market has dropped from a high of 11.8 percent to 4.1 percent. That’s a good sign for the office market: As people return to work, companies will eventually begin filling office space again, both in the urban centers of the Twin Cities and across its suburbs.

And while a dipping unemployment rate is good news, so is a rising rate of vaccinations. Avison Young said that vaccination rates across the Minneapolis-St. Paul area continue to outpace total U.S. numbers. So far, 54.5 percent of adults here have received a COVID-19 vaccine.

At the same time, the state of Minnesota recently announced a new recovery budget designed to further stimulate the local economy. The hope is that this combined with the rising vaccination numbers and dropping unemployment figures result in an increase in the number of people returning to their offices and a resulting rise in demand for office space.

The raw numbers in Avison Young’s report show that the office market in the Twin Cities still has a ways to go before it enters recovery mode. Avison Young reported that office leasing activity has largely paused, decreasing by 45 percent when compared with long-term historical averages.

At the same time, the office vacancy rate for the Twin Cities market stood at 10.2 percent at the end of the second quarter of this year. That’s up 190 basis points from the sector’s pre-pandemic vacancy rate of 8.3 percent.

The market’s office sector has also seen negative 1.38 million square feet of net absorption from 2020 through the first quarter of 2021. This amount of negative net absorption has significantly surpassed the lows of the global financial crisis in 2008 and 2009.

Not surprisingly, the amount of office sales has also dipped significantly since the start of the COVID-19 pandemic. As Avison Young says, office sales activity has temporarily paused. The Minneapolis-St. Paul office dollar volume of sales hit $1.3 billion from the start of 2020 to this point of 2021.

That’s a significant drop from usual sales activity, with Avison Young reported that the dollar volume of office sales in the Twin Cities market has decreased by an annualized rate of 29 percent compared with the prior five-year average dollar volume.

Again, these numbers sound ominous. But the good news is that COVID-19 cases continue to fall and a growing number of people are receiving their vaccinations. If that trend holds, there is hope for at least the early stages of an office market recovery in the Twin Cities during the second half of 2021.

Opportunities in the Industrial Real Estate Industry

Industrial Real Estate Watch

Now the industry real estate industry is bustling, various enterprises rush into gold. However, opportunities and challenges often exist side by side. Behind the bustle may be riddled with all sorts of traps.

For example, there is a well-known industrial real estate operators in a city development park project, investment smooth, sold very well, so immediately launched the second phase. However, after the launch of the second phase, no customers, unable to complete the investment. The reason for failure is that a city's enterprise customer base is fixed, the first phase has digested the customer, to the second phase there is no customer. Experienced industrial real estate developers will miss, let alone cross-border developers.

So where are the opportunities in the industrial real estate industry?

Simply put,Industrial real estate opportunities from industrial transformation and upgrading.

Because economic environment, industrial policy and other factors have changed, the industry needs transformation and upgrading. Enterprise production, technology, customers, market changes,Companies will either transform and upgrade or fail. In this context, the demand for carriers and services in enterprises has led to the development of industrial real estate industry.In other words, if the industry does not need transformation and upgrading, there is no industrial real estate.

Industrial transformation and upgrading bring two opportunities: First, industrial transfer; Second, industrial integrationIndustrial transfer is the cross-region migration of enterprises, while industrial integration is the agglomeration of enterprises in regions. Based on this, the customers of the project enterprises in the park can be divided into foreign enterprises and local enterprises.

For private real estate developers, the opportunity lies mainly in industrial integration, that is to say, the investment target is mainly local enterprises.Although foreign enterprises can be imported, it is relatively difficult. Because the enterprise is very cautious in the location, dare not move easily, for fear of staff loss, market loss and other problems. When enterprises choose to migrate across regions, it considers a lot of factors, such as land, preferential policies, subsidies, these are not private industry developers can meet.

Some developers hope that after the completion of the project can introduce a large number of foreign enterprises, which is unrealistic. In fact, to undertake industrial transfer is a matter for the government to attract investment. If private industry real estate to participate in the transfer of industry, must be homeopathic, follow the government's investment policy.

So, more precisely,Opportunities for Private Industry Real Estate Developers from Industrial Integration. Private property developers need to focus on local businesses to find gold from this sector.

The number of local businesses determines whether there are opportunities and how large they can be.In doing industrial positioning, we need to investigate the number of enterprises in the region, roughly distributed in which industrial fields. If there are a large number of SMEs in the region, they have not solved the problem of industrial transformation and upgrading, this is the opportunity.

Industrial real estate must not blindly follow suit, see a park project done well, blind follow-up, this is taboo. After the completion of industrial real estate projects, if the introduction of enterprise customers, will inevitably lead to the project vacant.

Enter the field of industrial real estate, we should be fully prepared,In-depth research on industry and enterprise entry and determine the opportunity to re-enter.

Steps to Consider Before Investing a Divorce

Bernstein

Despite a couple’s best intentions, divorce remains remarkably common, with the American Psychological Association estimating that 40 to 50% of married US couples will eventually part ways. Divorce can be fraught with emotion and logistical considerations. But while the circumstances of a split can vary, a desire for clarity is universal—especially for the non-monied spouse. To help alleviate anxiety, structure is vital for the spouse earning less income, who is likely wrestling with many questions:

Will my settlement be enough to sustain my lifestyle?

How should I invest settlement funds?

The market is at (or near) an all-time high; is it prudent to wade in right now?

Does it make sense to invest all at once, or should I stage my entry over time?

While these questions may seem daunting, tackling them head-on—and sooner rather than later—can help lay a stable foundation during a transition. With robust modeling, a financial advisor can map out a course of action that makes the most sense for a recently divorced investor.

Strategize for a New Reality

Consider the case of Sheila, a 55-year old woman recently divorced from her wife, who was the high-income earner in their household. Sheila received a healthy cash settlement. However, it was clear she would need her assets to grow to meet her lifestyle needs moving forward. Her liquid and retirement assets totaled just over $9.0 million; her spending, just over $265K annually.

We started by determining Sheila’s core capital—the amount she’d need today to sustain her lifestyle with a high degree of confidence for the rest of her life. Then we determined if she had any surplus capital—wealth above and beyond her core that can be used opportunistically in the pursuit of secondary goals. From there, we mapped out Sheila’s investment strategy.

One of the more important decisions Sheila made was to decide on the appropriate asset allocation to meet her risk tolerance and income needs, which were very different from how the assets were invested during her marriage. Working with her Bernstein advisor, Sheila felt comfortable allocating 50% of her portfolio to stocks and the other 50% to bonds. However, as the time to deploy her cash came near, she felt torn.

Market Highs: A Red Flag?

The reason for her concern was valid: markets were close to all-time highs. Some analysts anticipated a correction, with high volatility and lower returns from traditional asset classes over the near term. While it’s understandable how these sober forecasts could give any investor reason for pause, they were even more concerning for Sheila. Her divorce settlement proceeds were her entire nest egg. Wouldn’t investing at a market high bring on the risk of losses in the months and years ahead?

Unfortunately, there is no way to fully remove the potential for market dips for an equity investor. But trying to time a perfect entry point almost always leads to losses. That’s because cash that sits uninvested for too long misses out on gains. Context is helpful: because the market has historically trended higher over the long term, it has traded near its all-time high roughly 43% of the time. Since World War II, investors buying at each market low earned an average of 11.5% annually, versus 9.6% for investors buying at each market high. The takeaway: buying even at market highs still provides an attractive return.

Inaction Is Action: The Cost of Delaying Investment

To aid Sheila’s decision, her advisory team ran a Wealth Forecasting Analysis, which quantified the cost of delaying her investment. The results were striking: If Sheila invested promptly, her assets were conservatively projected to grow at a rate that would meet her core capital needs. She would, in effect, have a secure financial future. If, on the other hand, she delayed investment for five years, she would forfeit critical portfolio growth, which could have increased her required core capital from $8.9 million to $9.8 million, costing her nearly $1 million and potentially putting her long-term financial security at risk.

Delaying Investment Increases Required Core Capital*

When to Enter the Market

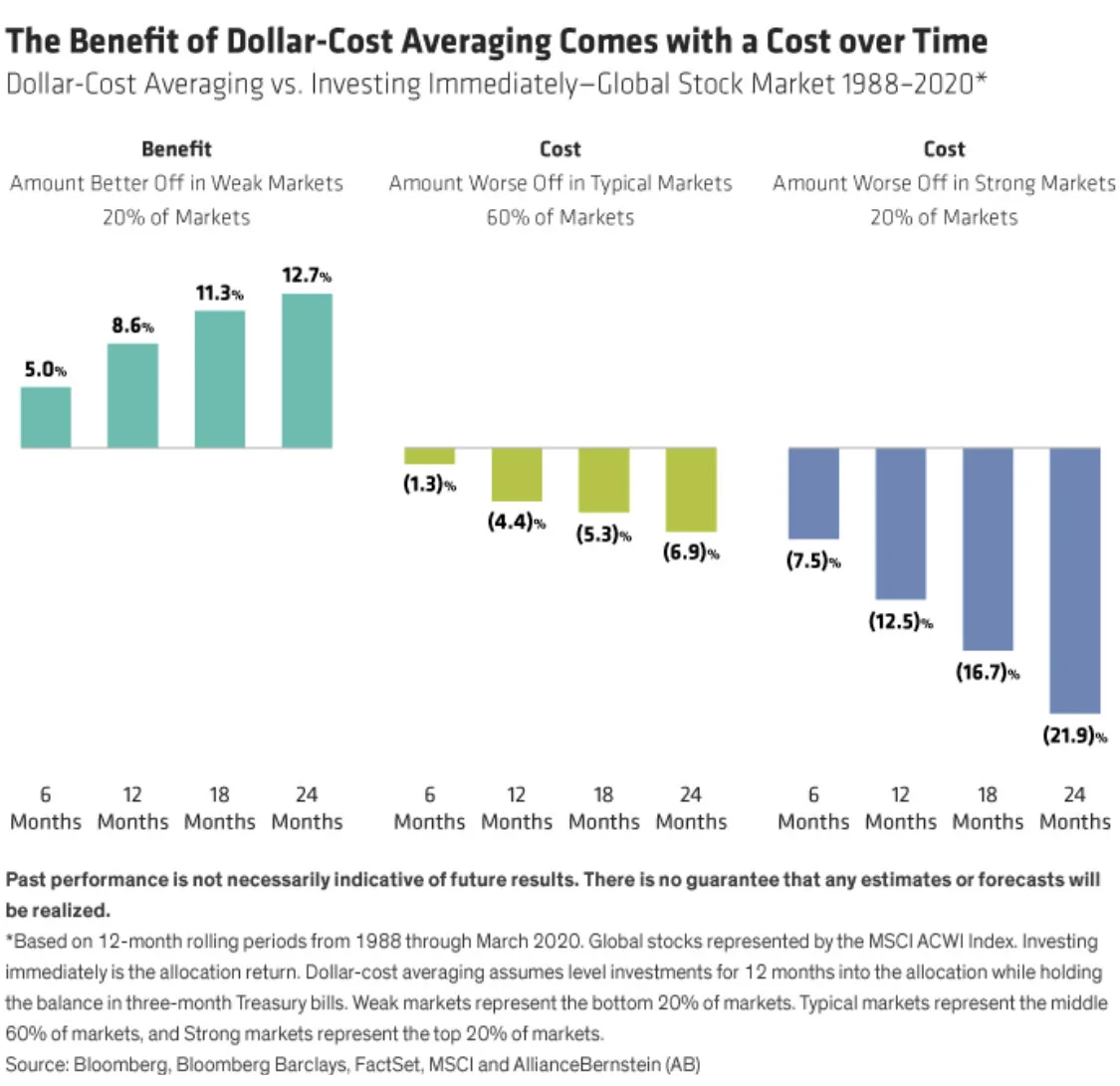

Understanding the market’s historical patterns—and how they’re playing out today—helped reassure Sheila. However, she still wrestled with the potential for a market downturn shortly after investing her entire settlement. Sheila’s advisor recommended a dollar-cost averaging (DCA) strategy—keeping six months’ worth of expenses in cash and investing the remainder at regular intervals over the course of three months.

Dollar-cost averaging is an effective way to achieve the most important step for a reluctant investor—getting invested—while hedging the risk of a near-term portfolio decline. It is important to note, however, that because markets tend to climb over time, DCA strategies typically generate less overall wealth than an “all at once” approach. That’s the trade-off: the longer the investment period, the lower relative returns will tend to be in typical and strong markets; returns will, on the flip side, be relatively higher in poor markets.

In any DCA strategy, time is the key. Beyond a six-month investment period, the benefit is outweighed by the cost of cash sitting undeployed. That’s why Sheila’s advisor believed that a three- to six-month investment timeframe was ideal for balancing her concerns against her need for growth.

The Benefit of Dollar-Cost Averaging Comes with a Cost over Time

Your Goals Are Our Benchmark

Whether you enter the markets all at once or more gradually, as Sheila did, the most important thing is to invest. It’s natural for investors to turn to frequently cited indices like the S&P 500 or Dow Jones Industrial Average as benchmarks for evaluating performance. A better measure of success in our view, especially in periods of life transition, is to consider your progress in light of the personal and financial goals you and your advisor agreed upon when developing your investment plan:

Is your asset allocation matched appropriately with your time horizon?

Do your investments align with your values?

Is your portfolio operating in such a way that you are sustainably able to get what you want and need, while also sleeping at night?

If you can answer “yes” to these questions, you’ve not only weathered the transitional storm—but are well on your way to a financially stable and empowering future.

Porotech's Micro-LED technology to enter mass production

EDN Electronic Technology Design

Porotech, a spin-off from the University of Cambridge, has raised £300,000 for the next phase of development of its unique Micro-LED technology. Its display technology breakthrough heralds a new era of brighter, clearer and more vivid miniature displays for even the smallest devices.

Micro-LED is the next big leap for displays in products such as smartphones, smartwatches and VR / AR headsets. It is particularly useful in outdoor settings, where sunlight often makes it difficult to see on existing displays. But the performance of current Micro-LED technologies deteriorates as device sizes decrease.

Porotech has created a new class of porous gallium nitride (GaN) semiconductor materials that redefine what is possible. It provides performance improvements suitable for volume production and can be customized to meet individual customer needs.

Despite only being established on January 20, Porotech has already generated 10 months of revenue - and is working with some of the world's biggest names in display technology. In November 2020, the company launched the world's first commercial native red indium gallium nitride (InGaN) LED epitaxial wafer for micro-LED applications.

“Micro-LED displays using GaN-based material technology are widely recognized as the only technology capable of providing sufficient brightness and efficiency to meet AR requirements,” Says Dr. Tongtong Zhu, CEO and Co-Founder of Porotech, “With AR glasses expected to one day replace smartphones - or at least reduce our interaction with devices in our pockets - it's vital to develop advanced materials to improve performance. "

“Integrating AlInGaP red and InInGaN green and blue LED displays into modules with micron pixels is extremely challenging, Because of the high surface recombination speed in AlInGaP devices, this material is not suitable for highly efficient Micro-LED. Our breakthrough extends the emission range of InGaN LEDs to meet the performance needs of red displays while providing the ability to extend the wafer sizes required for miniature LED semiconductor display technology.”

Porotech's native red InGaN miniature LEDs have a wavelength of 640 nm at 10A / cm2, And at very small pixels and spacing than conventional AlInGaP and color conversion red has higher performance.

the next step

Porotech will now work to extend its new approach to incorporating InGaN based red, green and blue (RGB) Micro-LED is integrated into full-color miniature displays - and ultimately creates "smart" pixels that can be independently controlled for unparalleled response and accuracy just like AR gestures.

Currently, smart pixel technologies being tested are mainly based on aluminum indium gallium phosphide (AlInGaP) and quantum dot color conversion (QDCC). But AllnGaP struggled with the small pixel size required for AR - and QDCC had uniformity and stability problems. In addition, both methods require mixing different materials.

For more information on technology

Porotech's novel approach enables all three primary colors to be made using the same GaN material and integrated on a single chip without special construction. The company also plans to develop its own supply-chain ecosystem to help it develop and produce products more quickly.

Dr. Tongtong Zhu, CEO and Co-Founder of Porotech, said: “Porous GaN is basically GaN with holes of tens of nanometers. “This is a brand new engineered GaN material platform for building semiconductor devices. It provides performance improvements suitable for mass production, scalable wafer sizes - essential for the next generation of micro-display devices such as AR glasses.

“We have seen high demand for our standard and custom porous GaN substrates and Micro-LED epitaxial wafers, We can offer these on 100mm (4 ") to 300mm (12") sapphire and silicon platforms.

“Smart pixels will be our next direction - monolithic generation and integration of native self-emitting RGB micro-LEDs on a single wafer, To provide smaller, lighter, thinner displays that use less energy and provide the higher accuracy required for AR gestures and the like.”

Porotech's latest funding round was led by Speedinvest, followed by previous investors IQ Capital, Cambridge Enterprise, Martlet and Bridge Angels.

Rick Hao, head of Speedinvest, said: “With growing demand for smaller, lighter, clearer displays that are more accurate and environmentally friendly than ever before, Porotech develops revolutionary technologies that will transform the electronics industry. "This new porous GaN semiconductor material is suitable for existing industrial processes and is robust and flexible enough to be customized for different applications."

Learning to motivate subordinates correctly is an essential skill for a qualified boss

Burmington Management Consulting Group

Motivation, at any stage of life is a very effective way to promote a positive attitude.

Babbling babies receive encouragement from their mothers to speak bravely;

Children who are new to school will receive encouragement from teachers and play with unfamiliar classmates.

Sons with poor grades will receive incentives from their mothers to work hard to improve their grades.

In the workplace, motivation is a means for the boss to strengthen the motivation of employees to get better results.

However, incentive is also a kind of knowledge, is good is twice the result with half the effort, with bad is to be counter-productive.

So how is it right to motivate employees? Let's look at the following questions first:

There is a horse in the distance. How do you attract it?

A. With grass B. With whip C. With mare D. Walk over and bring

You will find that no matter which method, can achieve the goal. But on closer reflection, each answer has its own problems.

If the horse is not hungry, A may not be effective, and if it is hungry, C. B and D, also if you can get close to the horse, what if you go there and it runs off?

To put it bluntly, how to motivate, or depends on the needs of the motivated. What he wants, what you give, is the best incentive.

In the incentive process, the direct supervisor and the human resources department need to cooperate with each other.

What the immediate supervisor has to do is:

The first is to conduct an employee needs survey, the second is personality needs inspiration, the third is the implementation of spiritual inspiration, and the fourth is to stimulate policy implementation.

What HR does is:

The first is the organization of employee needs survey, the second is the common need to motivate, the third is the implementation of material incentives, the fourth is to stimulate policy.

The main four steps:

Step 1. Investigate employee needs.

Every year, HR department should organize all departments to carry out employee needs survey to understand what employees focus on. Line manager should cooperate with HR department to do employee needs survey, explain the importance of needs survey to employees, ensure the authenticity of employee needs.

Step 2. individual requirements and generic requirements management.

According to the survey results of employee needs, to the common needs, human resources department should establish the company level to meet the needs of countermeasures; On personality needs, and line managers to research specific personality solutions.

The third step, material incentive and spiritual incentive double management.

Human Resources Department is responsible for formulating the implementation plan of material incentives to meet the needs of employees. Line manager to develop specific spiritual incentive programs to meet the spiritual needs of employees.

The fourth step, incentive policy management.

Human Resources regularly complete the incentive policy, supervise all departments to implement in place, line manager is responsible for the implementation of incentives in place. Joint efforts by both sides are really effective incentives.

Why Robots Will Multiply in the Warehouse

The impact of the pandemic on the warehouse industry will have long lasting effects on the industrial sector. From concerns of worker safety to the rush to keep up with the surge in e-commerce orders, the need for increased warehouse automation became evident.

Viewed initially as “early adopter” technologies only affordable to e-commerce giants, robotics are now considered mainstream and are expected to grow in use and popularity. Technology continues to improve and costs have come down making robotics and other automation systems in scope even for smaller and middle market companies.

The Extra Mile

Even before e-commerce’s recent surge, working in a warehouse has long been physically demanding work. In certain warehousing operations, it is not unusual for workers to walk miles per day picking products. Labor productivity is a big focus in warehousing operations which is why “goods-to-person” automation systems make sense.

By 2023, it’s expected demand will quadruple for these systems. One of the reasons: order pickers frequently spend 70-75% of their time traveling. A goods-to-person system can reduce or eliminate that travel, allowing the person to focus 100% of their time on the productive work, and with a properly implemented goods-to-person system, productivity can triple, allowing one person to do the work of three.

The growth of e-commerce has put increased pressure on labor. Today, direct-to-consumer fulfillment operations can require up to 10 times as many employees to individually pick, pack and ship goods. Attracting and retaining qualified workers remains one of the biggest supply chain challenges.

A study last year by Auburn University found that 80% of supply chain professionals considered attracting and retaining labor as a top priority issue. Warehouse wages are increasing, too. For some companies, robotic solutions could offer a better return on investment.

Need for Speed

Millennials are the least patient when it comes to impediments to speed compared to their generational counterparts. Sixty-five percent of them say that long wait times for pick up or delivery negatively impacted their shopping experience, according to a consumer survey by Big Red Rooster, a brand experience company owned by real-estate services firm Jones Lang LaSalle Inc. (JLL).

By 2030, next-day and same-day fulfillment will be the dominant customer requirement, said 80% of the Auburn University survey respondents. The online grocery segment too is scaling to deliver in hours. Online grocery has been one of the fastest growing segments of e-commerce and is anticipated to grow to $100 billion in sales by 2022 according to the Food Industry Association (FMI). Proof of this demand is also reflected as Kroger Co.’s fourth quarter digital sales grew 118%, according to a report by JLL.

Kroger and Britain’s Ocado Group Plc, which opened the first of up to 20 fully automated fulfillment centers in April 2021, will use artificial intelligence, robots with totes and a proprietary control system to pick and pack deliveries. The adoption of robotics and automation systems could help make these consumer expectations a reality.

Reducing Risk

Providing for an employee’s well-being, especially in a fast-paced, competitive distribution environment, is a critical success factor. Workers face a greater risk of injury when they are tired from working long hours, or continually doing repetitive and physically demanding tasks. Not surprisingly, these activities are exactly what robots excel at and desire.

Robotics company Boston Dynamics has created a machine called “Stretch,” which is capable of moving 800 boxes per hour in the warehouse and can potentially be used to unload trucks, strip cases off pallets, and transfer cartons to conveyors. This was driven by the need to manage high-speed operations as well as mitigate the increasing cost of labor.

Eighty percent of supply chain professionals expect greater investments in automation by their companies in the next 10 years, and 88% say they’ll be more reliant on automation and robotics in the nearer future.

New technology and demographics continue to transform the industry, pushing expectations to new levels. From a supply chain perspective, the global pandemic put a huge spotlight on risk management with a special emphasis on people. When it comes to labor, although robotics and automation will never eliminate the need for qualified employees, it certainly can help mitigate the risk.

Shrinking Size, Rising Average Price " China Refrigerator Market of May 2021 Briefing

According to GFK China Yikang market monitoring data, in May 2021, the refrigerator market retail sales of both channels showed negative growth, online and offline decline of 7.1% and 9.5% respectively.

In terms of price, the average price of two-line market showed an upward trend compared with the same period last year, including the online average price reached 1,882 yuan, an increase of 10.3% year on year; The average offline price reached 5,327 yuan, up 15.9% year on year.

Category, multi-door refrigerator market retail sales share is still outstanding, online and offline respectively reached 33.4% and 60.7%; Retail sales increased by 21.8% year-on-year online and slightly decreased offline.

At the same time, the average price of multi-door refrigerator also showed an outstanding increase, with the online average price rising from 3667 yuan in the same period last year to 4319 yuan, The average price of the line rose from 6,675 yuan to 7,437 yuan, the two-line average price in all categories in the top.

From the volume segment, in May 500L and over 500L double-line market share of retail sales are significantly increased, This increased to 33.2% online and 53.8% offline. From the price segment, online channel 4K products accounted for the largest share of retail sales, accounting for 38.5%, compared with 40.8% in the same period last year slightly shrinking; Offline 10K + high-end products market share of retail sales increased significantly, from 22.4% to 30.0%.

Sub-brand, the main brands of two-line average price overall increase, only a few brands fell. However, from the two-line market share of retail sales, each brand in the dual-line channel performance is different, the share is up and down.

In the market new TOP model list, more than half of the categories online channels, online channels also occupy an absolute advantage.

Farewell Letter from Ambassador Cui Tiankai to Overseas Chinese in America

Dear Overseas Chinese,

Time flies, time flies. Since April 2013, I have been serving as Chinese Ambassador to the United States for more than eight years. I will leave my post and return to China soon. This is the longest foreign assignment in my diplomatic career. I have experienced many historic events, made many warm and friendly friends, and left me many unforgettable memories.

On the occasion of parting, I would like to express my heartfelt thanks to the vast number of overseas Chinese in the United States for their concern and support for my work. I remember vividly that shortly after I took office in April 2013, dozens of overseas Chinese organizations held a grand welcoming banquet for me. It was the first major event I had attended since arriving in Washington. I remember vividly that on holidays, I had a long talk with my overseas Chinese leaders, listening to you share your in-depth observations on the United States and offering suggestions for developing China-US relations. I remember vividly that every time a Chinese leader visited the United States, he was greeted by overseas Chinese everywhere he went. The Chinese and American flags were waved in the wind and cheers were heard. I remember vividly that whenever my ancestral home country suffered disasters and disasters, overseas Chinese did not hesitate to make generous contributions. In particular, I remember vividly that over the years, overseas Chinese have lived overseas in love with the people of China. They have worked tirelessly to promote mutually beneficial cooperation and people-to-people exchanges between China and the United States, and have spoken out firmly to promote the reunification of the motherland and safeguard national dignity.

In a few days, we will mark the 100th anniversary of the founding of the Communist Party of China. Looking back at history, the sons and daughters of the Chinese nation are all filled with joy for the historic achievement of the great motherland from standing up, becoming rich to becoming strong. Generations of overseas Chinese have always adhered to the patriotic tradition and have never been absent in every period of China's revolution, construction and reform. They have made important contributions to the independence and liberation of the Chinese people and to the prosperity and development of the country. Looking forward to the future, China has embarked on a new journey of building a modern socialist country in an all-round way. This has provided broader and brighter prospects for the development of overseas Chinese. At the same time, we also need the vast number of overseas Chinese to exert their wisdom, contribute their strength, and make a unique contribution to realizing the Chinese Dream of national rejuvenation. I hope that the vast number of overseas Chinese in the United States will continue to cherish the hearts of their children, and work together with the sons and daughters of China at home and abroad to create a brighter future for China.

Since the establishment of diplomatic relations between China and the United States 42 years ago, bilateral relations have made historic achievements and the interests of the two countries have long been closely intertwined. Overseas Chinese in the United States have always been the private emissaries of Sino-US friendly exchanges with the advantage of integrating China and the West. At present, China-US relations are at a critical crossroads. The US policy towards China is undergoing a new round of restructuring and is facing a choice between dialogue and cooperation and confrontation and conflict. At this moment, overseas Chinese in the United States are shouldering more important responsibilities and missions. I hope you will continue to act as staunch promoters and active contributors to the sound and steady development of China-US relations, starting from defending your own rights and interests in the United States, safeguarding the fundamental interests of the Chinese and American peoples, and promoting world peace, stability and prosperity.

Friends at home, if the horizon neighbors. I will always cherish the deep friendship I have forged with all overseas Chinese during my mission to the United States. Finally, I sincerely wish you all good health, family happiness and good luck!

The People's Republic of China in the United States of America

Ambassador Extraordinary and Plenipotentiary